The fourth quarter is traditionally “budget season.” For those in financial planning and analysis (FP&A), you may be cringing at reading the words budget season. I cringe when I think about the many budget memories and late nights at public companies. Is v.21 of the Board deck ready? Ugh.

Founders, we are not going down that path of analysis paralysis. However, if you don’t budget, forecast, or plan, the time is now. Begin with something simple.

It seems like the economy is always being hit with some crazy news. To absorb these shocks, we need some forward-looking visibility around our business. Or at least dedicated thought put into this.

In this post, I’ll walk through my high-level steps of how I approach a budget and forecast. As a bonus, you can download my Excel template below to help you with the planning process.

This template was inspired by Jason Lemkin’s post on the “three financial plans you need for next year” and his L4M (last four months) planning concept.

I also have a free video lesson on this template and the L4M approach in my SaaS Finance 101 course. Enroll for free here. A nice SaaS P&L is a bonus by-product of this process.

Bookings

When I start my planning process, I always begin with bookings. Bookings drive revenue. If you don’t speak the bookings language, a booking is an executed customer contract for products and/or services.

Even if you don’t use the bookings syntax, you still need to approach your revenue planning in a similar fashion. We must understand the layers of MRR/ARR that will drive our revenue growth. I’m defining revenue in this example as recurring revenue.

These layers include:

- New business – dollars of revenue from new customers and counts of those new customers.

- Expansion business – dollars of upsell (more of the same product) and cross-sell (customer has A, we sell them B) revenue.

- Contraction – lost dollars from customer dropping products, seats, modules, etc.

- Churn – not necessarily a booking, but we need an estimate of lost MRR/ARR for the forecast period.

Creating a revenue forecast is also a data discovery process. A key mistake that I see with early SaaS companies centers on tracking critical data. You must track your layers of MRR/ARR above. Whether it comes in the form of a booking or a Stripe transaction, you need to track the dollars and counts each and every month. This data feeds so many important SaaS metrics (namely, sales efficiency metrics).

Headcount

One of the major expenses on a SaaS P&L is headcount. I hate to say “expense” for headcount, because it really is an investment. A SaaS company is people. Our competitive advantage is people. Check out my ROSE Metric post on organizational efficiency.

When thinking about headcount, we need to focus on headcount in cost of goods sold (COGS) and operating expense (OpEx). COGS headcount will scale with revenue. OpEx headcount will follow a more stair step growth pattern.

Pure-play SaaS COGS departments include:

- Customer Support – handle inbound “how to” questions and bug reports

- Professional Services – configuration, onboarding, training

- Customer Success (if they don’t sell) – focused on retention

- Dev Ops – hosting infrastructure, third-party products embedded in our product, CC fees, etc.

For COGS headcount planning, we must understand the drivers behind the headcount.

- Customer Support – does this scale with customer or user counts? Tickets?

- Professional Services – scales based on services backlog, project lengths, billable staff, etc.

- Customer Success – often driven by number of accounts or amount of ARR

- Dev Ops – depends on complexity of your hosting environment

We must understand the interactions between COGS headcount and gross margin profile. As we invest in COGS headcount, we may take a margin hit, but we want to see a path to solid gross margins. Please don’t show me a forecast where you go from 60% to 85% margins in one-year.

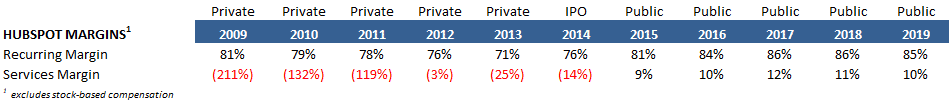

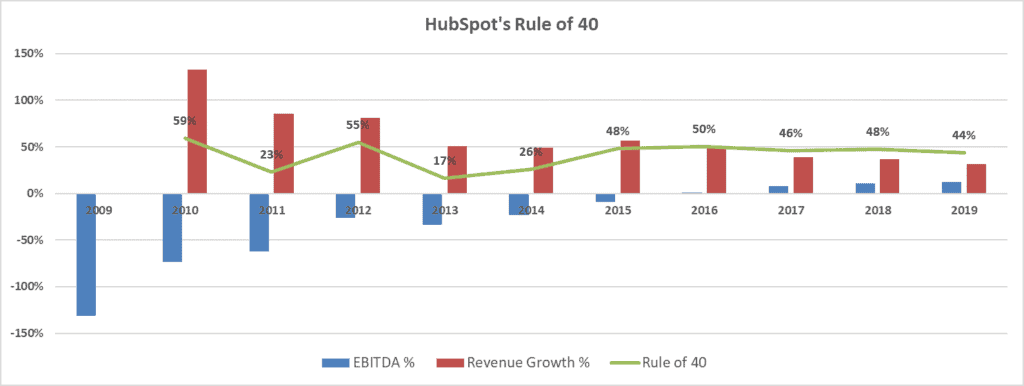

HubSpot is an interesting case study and how its margin profile changed as it transitioned from private to public company.

SaaS operating expense departments include:

- R&D – feature development and bug fixes

- Sales – drive revenue growth

- Marketing – drive pipeline and branding

- G&A – finance, accounting, HR, internal IT, legal, CEO

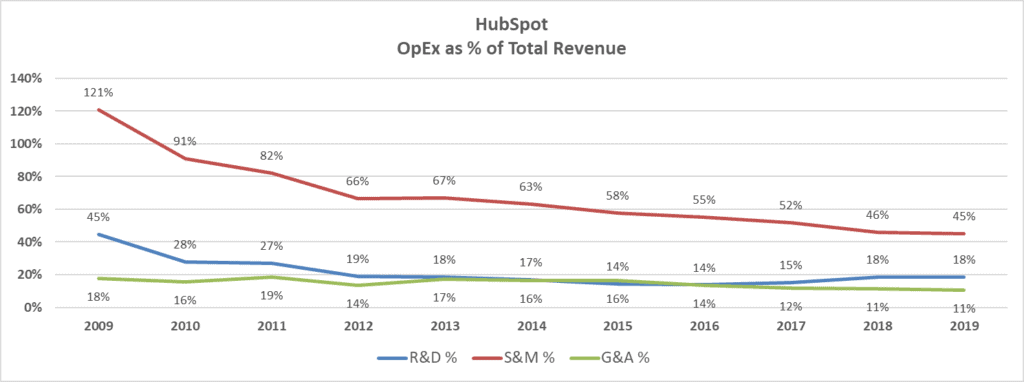

OpEx should not scale like COGS. We continue to invest to support the growth and infrastructure of our business, but these departments should become more efficient over time.

How do we measure efficiency? A common method is to divide the department’s expense by total revenue. See HubSpot’s profile below. Over time, operating expense grows but decreases as percent of revenue.

OpEx profile management is a key financial management function. Early on in your SaaS’s life, it has less meaning. But as you scale, it will be a focus. SaaS CFO’s have financial profile targets in mind. We also crave operating leverage.

Non-wage Expense

Now, we need to fill in the major buckets of non-people expense. For SaaS companies, it typically consists of:

- Rent (well, maybe, not anymore?)

- Travel

- Internal-use software (Salesforce, HubSpot, Zendesk, etc.)

- Outside services (consultants, legal, tax, audit, etc.)

- Conferences

- Marketing/promotional

- Transaction fees

- Non-capital expenditure hardware (i.e. employee laptops, etc.)

Of course, there are tons of other expenses, but think about your major non-wage expenses and how they will trend. For a very simple plan, you can get away with trending these as a flat monthly number. If you know the timing or seasonality, even better.

Next Steps

If you are ready to create a simple financial plan for this year or next, follow these steps.

- Download my L4M planning model below

- Watch the free video lesson here

- This will get you on the right path for creating a very simple plan

- Set your bookings target

- Think about the resources needed to support your bookings target

- Headcount and compensation in COGS and OpEx

- Non-wage investments in training, internal-use software, etc.

- With your simple plan in hand, it will act as your guide rails each month

- Are we on track with bookings and revenue?

- Then continue to invest to support this growth plan (cash in mind, of course)

- Are we off track on bookings and revenue?

- Do we need to pull back on new hires and non-wage investment?

- How is our cash tracking? What is our cash runway?

- Are we on track with bookings and revenue?

Financial Planning Models

I have various models that require beginner to advanced knowledge to operate. If you are ready to move on from the L4M model, you can try the free Excel templates below.

L4M Model

Beginner – enter basic cash receipts and uses of cash

Novice – This startup model is a slimmed down version of my advanced model

Advanced – my five-year forecast model

With forecasting and budgeting, I follow the 80/20 rule. Focus a majority of your time on the major items (revenue, headcount, non-wage expense) that will make your plan a good estimate. Don’t get distracted by a $100 expense. Start with small steps and basic models and work your way up from there.

The L4M financial planning model does not require my process above. However, applying my concepts will provide a framework to work through your planning process.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Ben – its been my undertstanding and practice to put CSMs in opex – ie in the cost of sales and marketing as they are used to retain/grow existing dollars. They therefore are in the magic number calc but are not in cogs. thoughts?

Hi Brett,

If CSM’s are purely focused on retention and do not have a quota, I put them in COGS. If they have a quota for expansion, I put them in OpEx.

Ben