What is Customer Lifetime Value (CLTV)

Customer Lifetime Value (CLTV) is the revenue or margin that you receive from one customer over the lifetime of that customer. The term “Customer Lifetime Value” is known by many words. It’s also known as Lifetime Value (LTV) or CLTV.

In this post, I explain how to calculate Customer Lifetime Value (CLTV) in SaaS and how to correctly apply it. In my free Excel download below, I walk you through basic customer lifetime value formula to the advanced and provide examples for each scenario.

My Excel Template Can Be Downloaded Below

How to Calculate Customer Lifetime Value

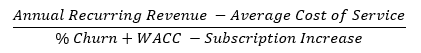

Depending on how you calculate CLTV, it can mean many things. Below is the formula I use to calculate CLTV. For me, this formula produces the lifetime margin (factors in ACS) of one customer after discounting for the time value of money (WACC) and churn but offset by customer subscription growth. Pretty wordy, I know. Think business valuations. You are valuing the cash flows produced by one customer.

What is a Good CLTV?

Is $5K good? $50K? $100K? In isolation it is hard to say and depends on other factors in your business. For some businesses, $5K could be a great lifetime value while $100K is really bad to others.

CLTV is most useful when compared to your customer acquisition costs (CAC). This comparison manifests itself in the often-discussed CLTV to CAC ratio.

Customer Lifetime Value Example

CLTV is really meaningful when compared to your CAC (customer acquisition costs). For example, if it costs $10K to acquire one new customer and your CLTV is $10K, you’ve got trouble. Your CLTV to CAC ratio is equal to 1. Meaning, you made no money off this customer. $10K out the door to acquire the customer (expense) and $10K in the door (revenue or margin).

I suggest using a CLTV formula that incorporates customer margin. Why? If you use the customer’s lifetime value of revenue, you have not considered any of the costs to support that customer during their time with you.

Experts in the field such as David Skok suggest a 3 to 1 ratio on CLTV/CAC. For every dollar of customer acquisition cost (CAC), you should be returning $3 of customer lifetime value.

I view CLTV/CAC as the return on your customer acquisition investment.

If CAC is new to you, CAC is simply the sales and marketing expense spent on acquiring new customers divided by the number of new customers acquired. You can read more about customer acquisition costs (CAC) in my previous post.

CLTV Formula Inputs

To calculate CLTV in my example, you will need your ARPA (average recurring revenue per account), ACS (average cost of service per account) or multiply your ARR by your recurring gross margin percentage, WACC (weighted average cost of capital), dollar churn percentage, and average dollar percentage growth per customer. This is the version that I use, but there are many versions out there. If this formula doesn’t strike a bell with you, try some other variations noted in the resource section below.

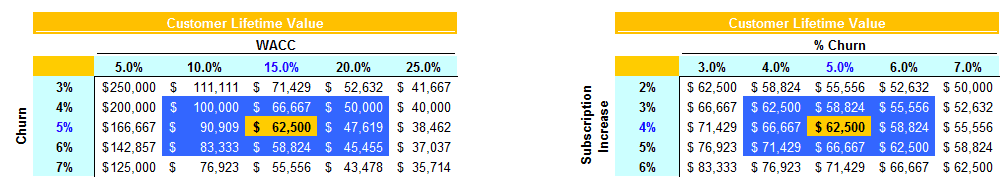

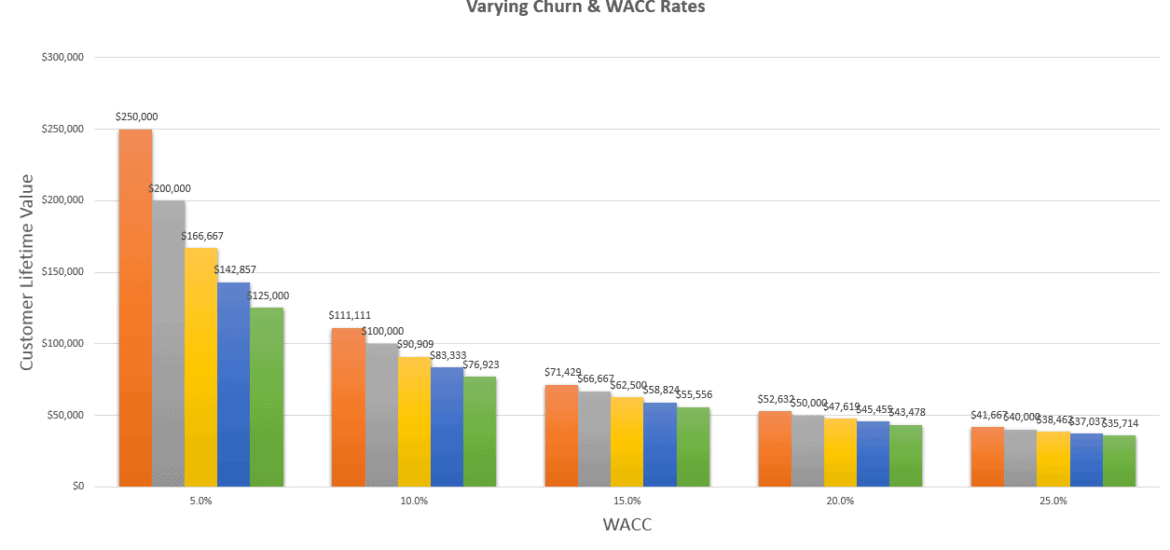

In my template, I also include sensitivity tables to understand how changes in two variables affect the customer lifetime value formula.

Why I Like CLTV/CAC Ratio

Simply put, you don’t want to spend more on customer acquisition than the lifetime margin of that customer. Just like net margins, you want an increasing CLTV/CAC ratio.

CLTV Considerations

This is a point in time calculation. Meaning, next month your numbers will be different based on the performance of your business. That’s where cohort analysis comes into play. This month, your CLTV could be $20K and your CLTV/CAC ratio is 1.5, and next month it could better or worse. Let’s hope for better.

Most likely your WACC remained constant but you improved your churn rates and your account executives grew the existing customer base at a better rate. In that case your metrics would improve.

CLTV Resources

If you would like to read more advanced posts on this topic, David Skok has a great post here on customer lifetime value. David Key also has a great post that takes you from a basic CLTV formula to an advanced CLTV calculation.

Conclusion

There are many SaaS metrics out there, but CLTV and CAC are metrics that I would be measuring to understand the unit economics and the health of your SaaS business. Remember, you don’t want to spend more on acquiring a customer than the total return on that customer. Please post your comments and feedback below.

Download Below

Please enter your email address (no spam) below to download the model. I’ll keep you updated on future models and posts.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Great piece. The biggest issue in start ups and small companies is the lack of a formal collection process.

Thanks for the comment, Eliot. Yes, making sure you are set up to efficiently collect this data is so important. Correct general ledger structure, correct data capture in your CRM and so on.

Ben – Great resource, thank you. Question – why do you subtract the subscription increase in the denominator? If the subscription increase is larger than the %churn + the WAAC you end up with a negative LTV. Is that correct? In a “land and expand” enterprise model, you might expect your subscription increase to be 50% or more. Thoughts?

Hi Andrew,

Subtracting the subscription increase reduces the denominator which in turn increases the LTV. But, yes, that is the tricky part of LTV. You can end up with an almost infinite LTV as the denominator gets smaller. Subtracting the subscription increase helps promote awareness that the MRR or ARR of customer does not (most likely) stay static over the lifetime of that customer. Expansion by some customers will help offset churn and downgrades in others to help overall LTV.

Regards,

Ben

Hi Andrew – When using your $ churn % are you using the gross or net dollar % churn?

many thanks

Stewart