Introduction to the Cash Runway Forecast

I was speaking with a SaaS founder about his forecast process, and he mentioned that he had received funding without a “sophisticated” financial forecast. He didn’t provide a three to five-year P&L forecast, but rather a simple cash forecast which included a cash runway forecast.

He used a free tool at https://startuprunway.io/ which I had not seen before. I was inspired by the creators of that cash runway tool to simplify my SaaS Financial Plan to a one-tab cash forecasting model.

So, if you are looking for a simple cash forecasting model in Excel, check out my free Cash Runway Forecast download at the bottom of the page. I automated a lot of the formulas, so that you can easily spread your cash forecast without a lot of manual data entry.

For more details on how the cash runway model works, keep reading. Or if you want to download the Excel model now, scroll to the bottom of the page.

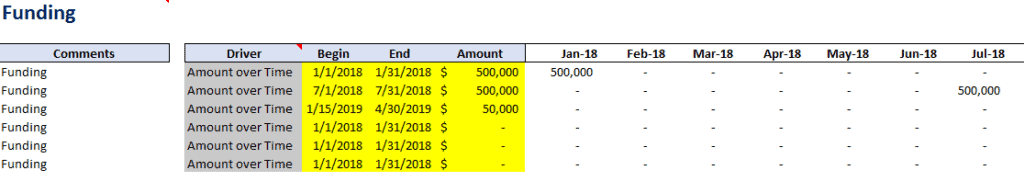

Funding Section

The cash runway model has three major sections that require input. The first section is Funding which is the cash inflow. In the funding section, input the cash investments in your startup. This could be your own capital and/or your investor’s capital and/or debt funding.

The yellow sections require your input and the grey Driver section requires a selection from the drop-down menu. Based on your selection of the driver, the model will place dollars in the appropriate months.

The mode has been built for a five-year time frame, but I really only see it being useful for a twelve-month horizon where you have a general idea of your cash inflow and cash burn.

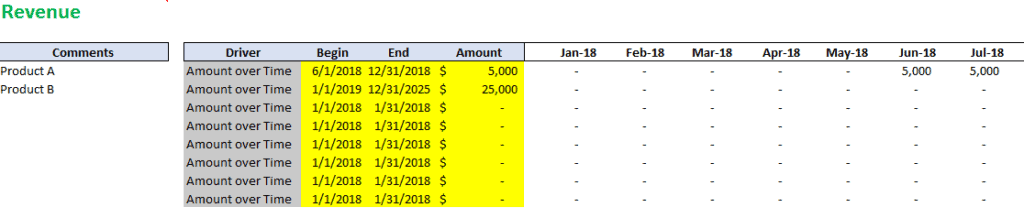

Revenue Section

The revenue section is also part of your cash inflow. Enter dollars for when you will receive cash from your customers based on your invoicing cycle. This section has nothing to do with revenue recognition.

If you are MRR-based and invoicing monthly, then most likely you will be receiving a steady stream of monthly cash payments.

If you are ARR-based, your cash receipts might be a little more seasonal based on the annual invoices going out each month and the lag between invoicing and payment.

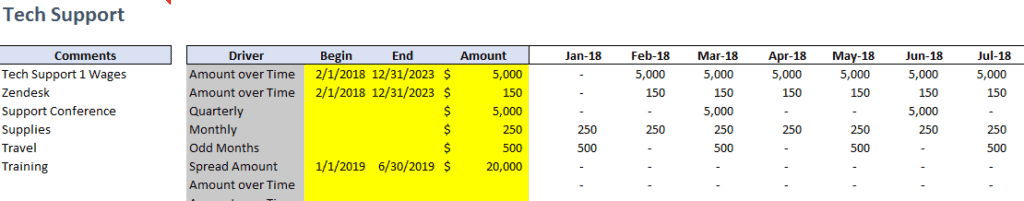

Department Expenses Section

The department expenses section includes eight areas to enter operational expenses specific to the common departments in a SaaS company. However, it doesn’t matter if you are SaaS or some other type of company. The model is applicable to all. You can relabel the departments as you wish.

You also do not have to forecast by department. You could enter all of your cash expenses in the Tech Support section. However, investors will want to know how you are spending the cash inflow.

- Tech Support

- Field Services

- Customer Success

- Cost of Operations

- Product Development

- Sales

- Marketing

- G&A

How to Calculate Cash Runway

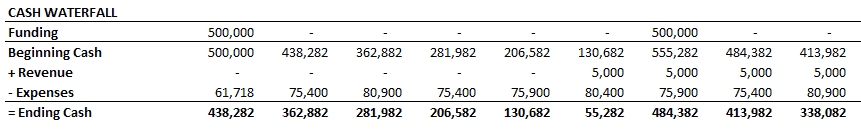

Your net cash burn or net cash inflow is the sum of your funding, revenue inflow, and expense outflow. At the top of the spreadsheet, I sum the inflow and outflow to determine your ending cash balance.

The forecasted ending cash balance is your cash runway.

I also summarize your spend by each section of the cash model – Funding, Revenue, and each department.

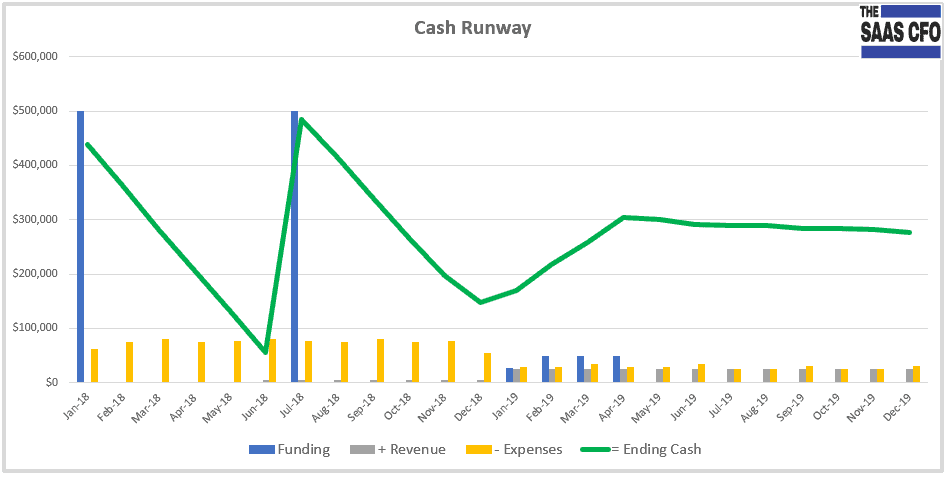

Cash Burn Chart

Last but not least, is the cash runway forecast chart. It visual depicts your funding, revenue, and expenses. The green line depicts your ending cash balance for each month in the forecast.

That’s it! Please download the free Excel model below. If you have any questions, comments, or suggested changes, please contact me.

If you require a full SaaS forecast model, check out my SaaS Financial Plan.