We know churn is bad for our SaaS company. Yes, we are losing customers and revenue. This impacts growth, metrics, and cash to name a few.

I’d like to dive into the financial details as to why churn is a SaaS killer. We hear a lot of rules of thumb in SaaS. Those can be great at a high level. However, to scale our SaaS business, we must understand more about the financial mechanics of SaaS.

To understand why churn is a SaaS killer, I’ll explain why CAC is like debt, the interaction between CAC and CAC payback period, and the danger of early churn.

CAC is Like Debt

Debt takes on many forms within a SaaS company. It could be MRR financing or a traditional bank loan. Typically, there is a principal balance that you repay over time along with some type of interest component.

CAC is no different. Customer acquisition costs are the sales and marketing expenses associated with acquiring new customers. With every new customer we acquire, our SaaS company creates a debt (CAC) in the form of sales and marketing expense that must be repaid.

CAC is the principal amount that must be repaid. Just like debt. Interest comes in the form of opportunity cost. If our capital was not tied up in CAC, where else would we invest in the business? Opportunity costs may be invisible or nebulous, but it is real.

CAC and Debt Duration

With debt there is a trade off when considering duration. Longer repayment schedules mean lower payments and more flexibility, but it also means higher interest expense. Long CAC paybacks have the same effect. High opportunity cost and internal capital dedicated to paying off the CAC balance.

In SaaS, the shorter the payback, the better. If our CAC is being paid off slowly, our internal capital is tied up in our go-to-market (GTM) engine. We can’t use this capital elsewhere in our business until it’s paid off. We need other sources of cash (operating cash balance, debt, equity) to fund increases in internal investments.

The CAC number in isolation doesn’t mean much. We must compare CAC to customer LTV. Customer lifetime value is the total cash flow we receive from a customer over its lifetime with us. If CAC equals LTV, you are in trouble. We must also use CAC in the CAC payback period formula.

If there are inefficiencies in our SaaS business model, our company’s cash engine slows and may grind to a halt. A long payback period is one contributing factor to SaaS companies running out of cash.

CAC Highlights:

- CAC is just like debt.

- With each new customer, you take on CAC debt.

- CAC can tie up internal capital.

- There is an opportunity cost to high CAC.

CAC Payback Period

CAC payback period is the number of months required to pay back the upfront customer acquisition costs after accounting for the variable expenses to service that customer. It’s one of my favorite metrics and appears to be an internet favorite as well.

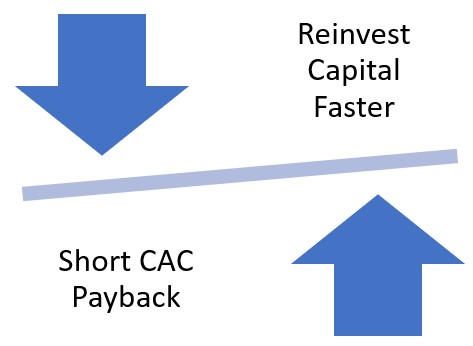

CAC payback represents our CAC debt payback schedule. Every SaaS company wants short CAC payback periods. Top performing payback periods allow us to reinvest capital faster back into the business. This could mean ramping up our GTM efforts and/or allocating capital to other departments.

However, slow payback periods tie up cash and make it difficult to reinvest faster in our business. With underperforming payback periods, we need additional cash sources if we want to increase investment in our business.

CAC Payback Period Example

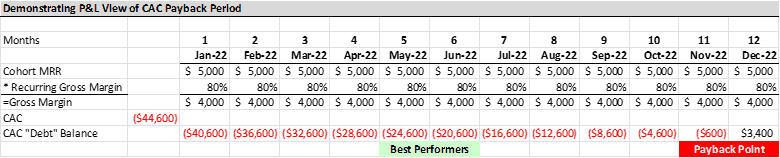

In the example below, our CAC is $44.6K (debt balance). It takes this SaaS company almost twelve months pay off this balance. However, based on SaaS benchmarks, for example, top performers in our peer group pay back CAC in 5-6 months.

Our cash is tied up for an extra six months compared to top performers. This sluggish performance requires more and more cash to sustain our growth rates. Faster payback is like cash recycling.

CAC Payback Period Highlights:

- CAC payback is like our debt repayment schedule.

- Long payback periods tie up cash; more difficult to allocate internal capital.

- Faster paybacks help “recycle” cash back into our business.

Losing Customers Prior to CAC Payback

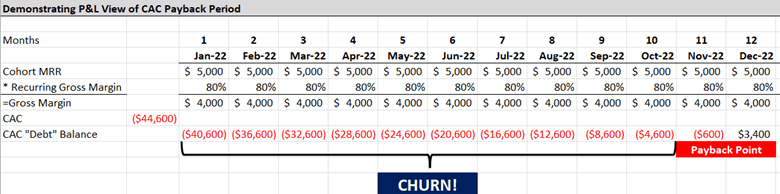

This is where it really hurts. When we lose customers prior to payback, the CAC balance doesn’t disappear. Just like debt, it must still be repaid.

The unpaid CAC balance and burden falls on new customers. New customers must repay their CAC and the unpaid CAC from churned customers. This puts more pressure on our cash generation ability. And more pressure to increase sales to fund the working capital of our GTM engine.

Unpaid CAC Balance

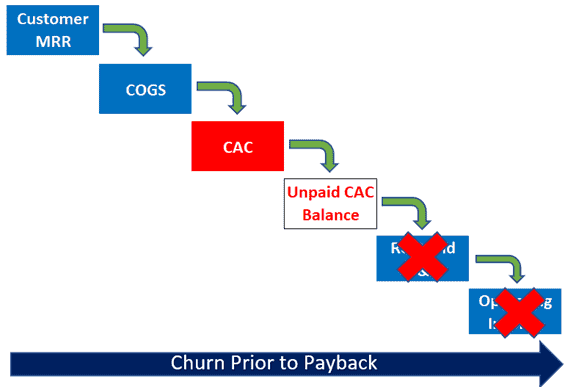

In the example below, if we lose a customer prior to the payback point, it creates an unpaid CAC balance. This creates hidden risks in our business.

We have not made any profit on this customer. In fact, we lost money. We covered COGS and that’s it. We only become breakeven at the payback point. This means we have covered COGS and the CAC balance. This creates “OpEx cashflow” to continue to fund or increase funding to R&D, sales, marketing, and G&A.

Highlights:

- Losing customers prior to CAC payback can be a SaaS killer.

- Poor retention and underperforming payback periods strain cash and our business model.

- New customer sales must maintain or increase to cover unpaid CAC.

CAC Payback Waterfall

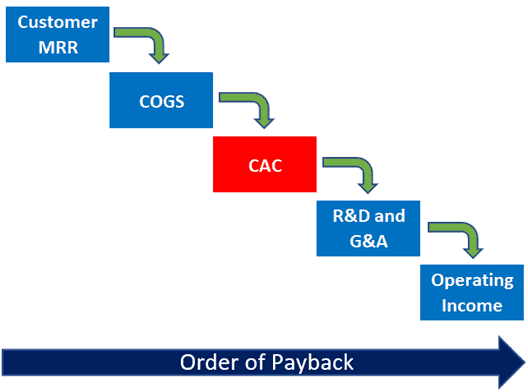

When we acquire a new customer, there is an order to the claims on that initial customer cash. Think of it like a cascading waterfall of cash (customer MRR or ARR).

First, with gross-margin adjusted CAC payback period, we must over our COGS. The customer is using our product so we must deliver on that promise through our COGS resources.

After we have satisfied COGS, the monthly variable profit on that customer is dedicated to repaying our CAC debt. This may only take a month to repay or may take years to repay. Benchmarking your CAC payback period is important. You must know how much pressure you need to apply to improving your payback period.

Once we reach the payback point, CAC releases all claims to the customer MRR. This creates “OpEx cashflow” to cover our operating expenses. If we can cover our operating expenses, we will then create operating income in our business.

Broken CAC Waterfall

If a customer churns prior to payback, our cash waterfall stops. Payments stop to cover CAC and not a single drop of cash is available to fund R&D and G&A.

The unpaid CAC balance strains our working capital and puts more pressure on customer acquisition.

Action Items

When you reach the point of “material” investment in your GTM engine, you must understand your CAC profile. Chur is a SaaS killer when we tie up our working capital in long payback periods and we have material churn prior to payback.

- Calculate your CAC payback period.

- This requires your CAC number and your recurring gross margin.

- Calculate your LTV to CAC.

- Are we too close to a 1 to 1 relationship?

- Calculate the distribution of your churn.

- How much churn do you have prior to CAC payback?

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.