MRR, or monthly recurring revenue, is the life of a SaaS business. It’s essential data to manage and improve your business. And the MRR schedule is one of the most requested data items in due diligence.

The SaaS MRR schedule, or sometimes called the MRR waterfall, is the source of key SaaS metrics. It’s also the data foundation that drives your SaaS valuation. Poor data here can cost you millions in valuation.

Despite the critical importance of the MRR schedule, it’s often the most difficult to produce. It requires good data hygiene, tracking, and technology.

In this post, I lay out the framework and importance of your MRR schedule. I also cover the SaaS metrics derived from this data.

Source Data for the MRR Schedule

There are several sources of data to create your MRR schedule. You can use invoice data, bookings data, or a revenue recognition schedule.

When using source data such as invoice and bookings data, we need four key fields. We require the customer name, ARR or MRR amount, subscription start date, and subscription end date.

It’s not that much data but often the most poorly tracked. Anyone use a description text field or memo text field in your invoice to specify the subscription dates? Even that is a start but then we must work a bunch of spreadsheet magic to extract the dates.

I’ve done this but it is not ideal. What if there is an extra space? Or an improperly formatted date? This makes your data life miserable.

Same thing with bookings data. You must track the four fields mentioned above in your closed won report. You must also track this for each new win, expansion deal, and contraction deal. We need these three layers of MRR/ARR to translate the data into an MRR schedule. And don’t forget churn tracking.

Finally, the rev rec schedule. This is the utopia IF we have proper revenue recognition in place. We can shortcut a step in the process and paste the revenue schedule directly into my revenue retention template below.

Steps to Create Your MRR Schedule

Step 1 – Translate Transactional Data

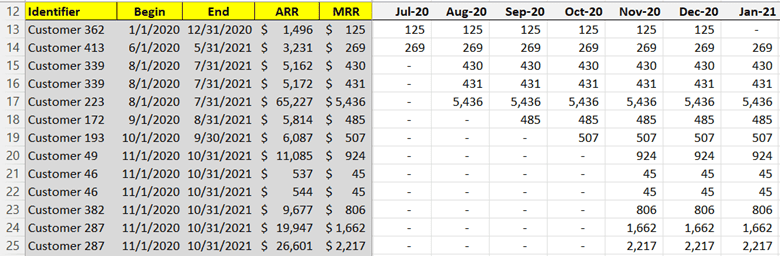

With invoice or bookings data in hand, we can paste this data into my MRR schedule template below. My MRR schedule file is a quick and easy way to transform the data from vertical to horizontal.

Keep in mind. This is not meant to be a perfect revenue recognition schedule although it will be close. I normalize the dates for the first and end of the month so that we have simple formulas to spread the data. It gets complicated fast when trying to make this an auditor-ready deferred revenue schedule.

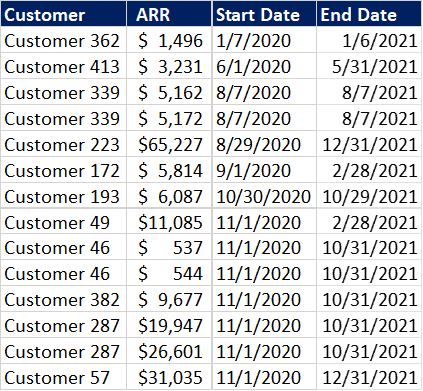

We paste the source data in.

The Excel formulas do the work and spread the ARR amount over the start and end date.

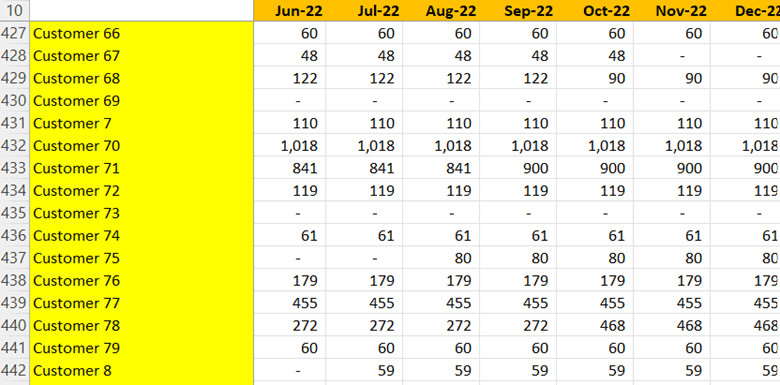

But wait? We are doing this by invoice or transaction. We need an MRR schedule by customer so that Customer 1 doesn’t appear on multiple rows because they have several invoices. This will make your retention analysis unusable.

I run a quick pivot to create a unique list of customer names.

This feeds the unique MRR schedule. That’s it! Done! We have our MRR schedule.

Step 2 – Create Your Retention Analysis

The next step is the easy step if you have a revenue retention template. Of course, you can download my template below.

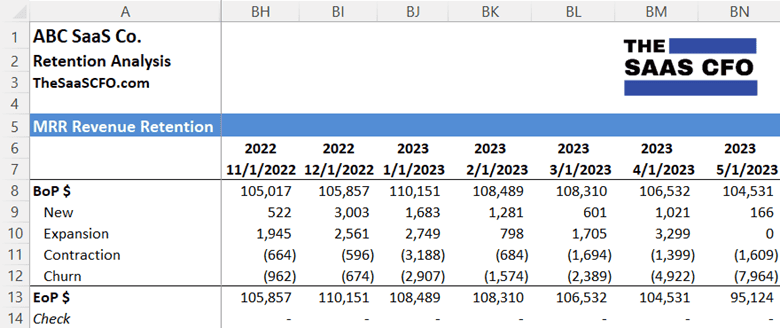

We just need to paste our unique customer MRR schedule into the template. We are able to create our layers of MRR schedule. This schedule then feeds our retention calculations.

With this spreadsheet magic, we can calculate customer retention, gross revenue retention, and net revenue retention.

I like to calculate retention metrics on a monthly basis and annualized basis. For annual calculations, I use the trailing three months (T3M) and trailing six months (T6M) of data. I convert this data into an annualized number. Remember to take to the power of X when annualizing. Don’t multiply by X.

MRR Schedule Nuances

Of course, with any SaaS metric or concept, there are nuances.

- Monthly invoicing – if you invoice monthly and post in the correct month (and/or charge via credit card monthly), your MRR schedule with equal your invoicing schedule. However, I see a lot of poor invoicing habits that prevent this.

- Revenue Recognition – the lovely world of rev rec is now always perfect. You have timing, catch ups, credit notes, etc. that cause havoc with your MRR schedule.

- Daily Revenue Recognition – this will affect your revenue retention calculations.

- Currency – if you invoice in multiple currencies, this can be a pain if you have to combine into a single MRR schedule. I like to leave in the base currency so my retention calculations work while noting the MRR may not foot to the consolidated P&L.

Due Diligence and SaaS Valuations

Your MRR schedule is a coveted item in due diligence. It will be requested! If you cannot produce a quality MRR schedule, your valuations will suffer.

Your MRR schedule feeds retention calculations which determine the health of your recurring revenue. I’ve talked to PE firms who will pass on a deal if you cannot calculate GDR/GRR or if your GRR is below 90%.

Your MRR schedule is a coveted item in due diligence. Investors always want this data.

Be prepared for this request well ahead of time.

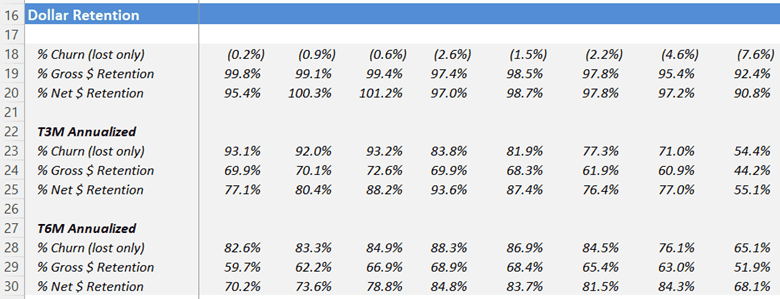

Combining Revenue Streams

Should we combine our MRR schedules? And calculate revenue retention in aggregate? No.

I like to calculate retention by major revenue stream. What story does each tell separately? THEN I combine the MRR schedules to see if the numbers tell an even better story. Is it moving up and to the right?

SaaS Technology

You can produce your MRR schedule via spreadsheets as outlined in the above process. However, at some point, you must transition to a subscription management system that will automatically produce your MRR schedule.

Check out the invoicing and revenue recognition sections in my 4th Annual SaaS Tech Stack report for the major players in this category. Your MRR schedule can literally be “push button.”

Takeaways

I can’t stress enough the importance of your MRR data. Your MRR schedule is the data input that determines the health of your recurring revenue. Start thinking about the current state of your invoicing, bookings, and revenue recognition data.

Clean MRR schedules are SaaS utopia for CFO’s. It takes a lot of process and systems work, but it must start from the source of the data. Otherwise, your downstream data is unusable and unrecoverable.

MRR Schedule Downloads

Jumpstart your process with my templates.

Revenue Retention Template

MRR Schedule

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.