Cash is always king. Forget SaaS metrics…no, just kidding. Whether you are a startup or an established SaaS company, cash is always on your mind. It’s not just “do I have enough” cash. It’s also where in my company do I invest the cash. Understanding your cash burn rate is a critical factor in how you manage your business.

There are three scenarios for operating cash. We operate with positive cash flow, breakeven cash flow, and negative cash flow. Each scenario dictates with cash burn rate measure to employ.

In this post, I’ll focus on the why, what, and how of cash burn rate. When I discuss operating cash flow, I will be using EBITDA (earnings before interest, depreciation, and amortization) as my measure. Download my free cash template below.

Want the video lesson on Cash Burn? Click here for the free course.

What is Cash Burn Rate?

Cash burn rate refers to the amount of cash your company uses in its operations. It implies that we are using more cash to fund our operations than the incoming cash receipts.

Every month is a constant cash flow cycle. We must pay employees, contractors, vendors, and so on. To pay the bills, we invoice our customers or charge their credit cards and collect cash.

If we have enough cash to cover operating expenses, we have positive operating cash flow. No need to calculate our net cash burn. Instead, we can calculate our gross cash runway.

If we do not have enough cash to fund operations, we are in a net cash burn situation. In this scenario, we will calculate our net cash burn rate and our gross cash burn rate.

How to Calculate our Cash Burn Rate

There are two main ways to calculate burn rate as mentioned above. We can calculate our gross cash burn and our net cash burn.

Gross cash burn is applicable in positive operating cash flow, breakeven cash flow, and negative operating cash flow situations. Net cash burn applies in a negative operating cash flow situation.

Remember! If you calculate cash burn today, this is a point in time calculation! It changes month-to-month based on invoicing and current expense levels. You can also forecast your cash burn rates to stay ahead of the game.

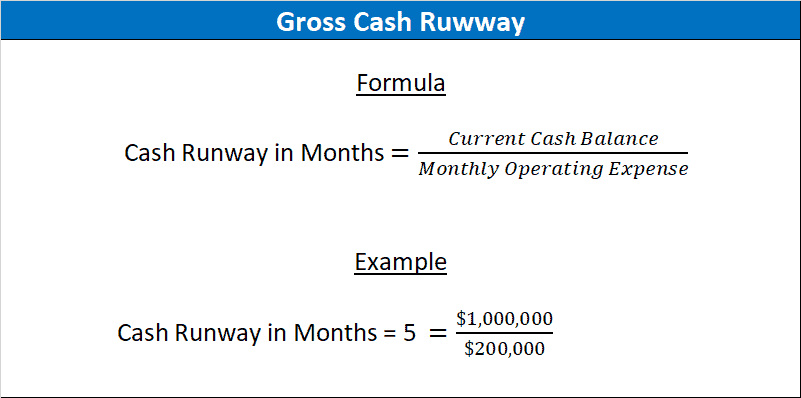

Gross Cash Burn Rate

Gross cash burn does not care if we have positive or negative operating cash flow. It simply wants to understand how long we could fund operations if we had no incoming cash.

To calculate gross cash burn, we require two inputs. We need our total P&L (income statement) operating expenses (excluding depreciation and amortization) and our current cash balance. I exclude the major non-cash items to make our output a little more accurate. Of course, there is always other timing with accrual-based accounting.

Total expenses include cost of goods sold (COGS) and operating expenses (expenses in R&D, sales, marketing, and G&A).

Gross Cash Burn Rate Example

Gross burn rate requires two inputs, cash and operating expense. The gross cash burn formula converts these two inputs into months of operating runway.

- We have $1,000,000 cash in the bank

- Our current monthly operating expense is $200,000

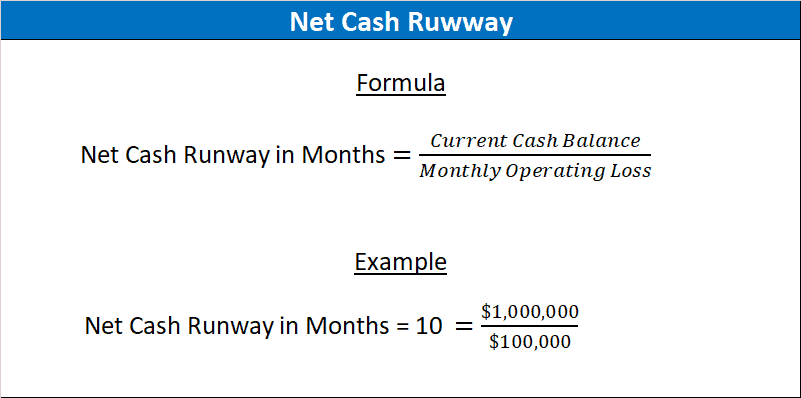

Net Cash Burn Rate

Net cash burn rate applies only when our company is performing at an operating loss. With net burn rate, we want to understand how long our cash will last based on our current monthly cash burn.

If we are in a cash burn situation, we must understand how long our current cash balance will last.

We require two inputs, our current cash balance and our current operating loss. I’m using EBITDA as a proxy for my operating loss. Our cash balance will be sourced from our balance sheet and our operating will loss will be sourced from our P&L.

Net Burn Rate Example

Gross burn rate requires two inputs, our cash and operating loss. The net cash burn formula converts these two inputs into months of operating runway.

- We have $1,000,000 cash in the bank

- Current monthly operating expense is $200,000

- Current monthly revenue is $100,000

How to Reduce Burn Rate

A net cash burn rate is often a choice. You are investing to fuel growth and market share, for example. But sometimes, we do not want to be eating into our cash balance. What then?

There are several major levers that we can pull to slow down our cash use. Of course, the biggest one is staff. It’s usually the largest expense on our SaaS P&L. We can slow down or stop hiring, or, in a worst case scenario, reduce headcount.

We can also manage our working capital. Working capital is difference between our current assets and our current liabilities. It really boils down to managing our accounts receivable and accounts payable.

- Accounts Receivable – push hard on cash collections and aging accounts. It’s “ABC” for CFO’s. Always Be Collecting.

- Accounts Payables – prioritize the vendors critical to your business. Pay them first and slow down payments to others. You hate to do that to vendors who must also pay their bills, but it is necessary to extend your cash runway. Or re-work credit terms.

There are many ways to extend your cash runway. The examples above are just a few. You can enroll in my free Focus on Cash course to learn additional tactics to extend your cash runway. Click here to enroll. Over 1,000 students have enrolled so far.

Takeaways

Founders, CEO’s, and finance must understand the dynamics of their cash flow. In this post, I focused on operating cash. But remember! After you fund operations, you may still need to make payments on debt or invest in capital expenditures. These items do not appear on your P&L. You must reference your cash flow statement for additional uses of cash.

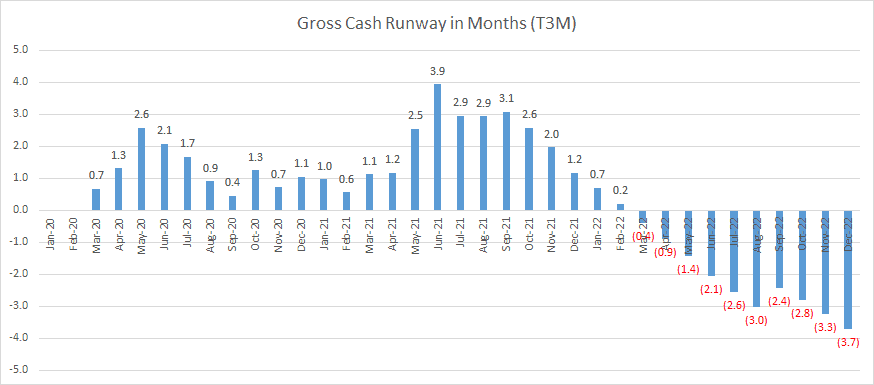

At a minimum, calculate your gross cash runway. How has it trended in the past? What is a comfortable balance? Three months of cash would be nice.

Forecast your financial performance to understand future cash needs. Forecasting your financials is critical to being proactive. If cash begins to dip too low, you can outline the financial levers that you can pull in your business to extend your cash runway.

Download my cash runway template below.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.