What is Committed Monthly Recurring Revenue (CMRR)?

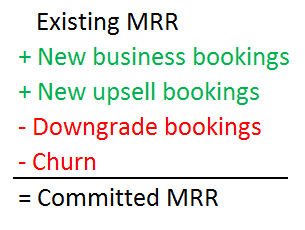

Committed monthly recurring revenue (CMRR) is a forward-looking SaaS metric that combines actual monthly recurring revenue (MRR) data with known bookings and churn data. It begins with your existing MRR (say, last month’s recognized MRR), adds known new bookings, and subtracts known cancellations and downgrades.

For businesses who sell annual contracts, you will calculate this as a CARR number, or committed annual recurring revenue.

It’s easier to picture CMRR with the formula below.

What is a Software Booking?

Before I go in depth committed monthly recurring revenue, let’s talk bookings first. Bookings are an important number in the CMRR calculation, so let’s make sure we are on the same page here.

I define a “booking” as an executed (signed by both parties) software contract that commits the customer to the purchase of a subscription and commits the SaaS company to the delivery of the service.

A booking is not revenue…yet. Bookings are a non-GAAP or IFRS measure, and there can be many interpretations. A booking will flow into revenue based on the terms of the subscription.

CMRR or CARR?

I live in the annual subscription world, so I think in terms of CARR, or committed annual recurring revenue. The only difference in thinking is monthly versus annualized terms.

Let’s address CMRR first for those who invoice monthly.

For example, if today is May 15th, you should know your recognized MRR in April. Let’s say that the number is $500K. Since you’ve closed April’s books, your sales and accounting teams have been receiving new orders, add-on requests, customer cancellation notices, etc.

CMRR would build upon your recognized MRR number in April and then include all the known new bookings, add-ons, downgrades, and cancellations to give you a “real-time” number for MRR. These orders and cancellations have yet to flow through revenue in your financials.

If you sell annual subscriptions, it’s the same methodology except you start with your base ARR (annualize April’s MRR number, for example) and add know bookings and churn. For ARR companies, I think of CARR as an exit rate. This is your new, net book of business going forward.

Why is CMRR Important?

CMRR is important, because it measures the net inflow and outflow of subscriptions for your SaaS company. Since recurring revenue is your economic engine, you’ll want to know if you are moving MRR/ARR up and to the right (net positive). Also, reporting just new business bookings to stakeholders can be misleading if your churn is significantly eating away at new subscription dollars.

Track your Bookings!

It goes without saying that every SaaS company should be tracking their bookings detail. This includes bookings from new business and existing business. But what about downgrades and cancellations? Yes, all of it. Track dollars and counts. Not only does this provide data to manage your business, but it will also save you time later if you are looking for investors.

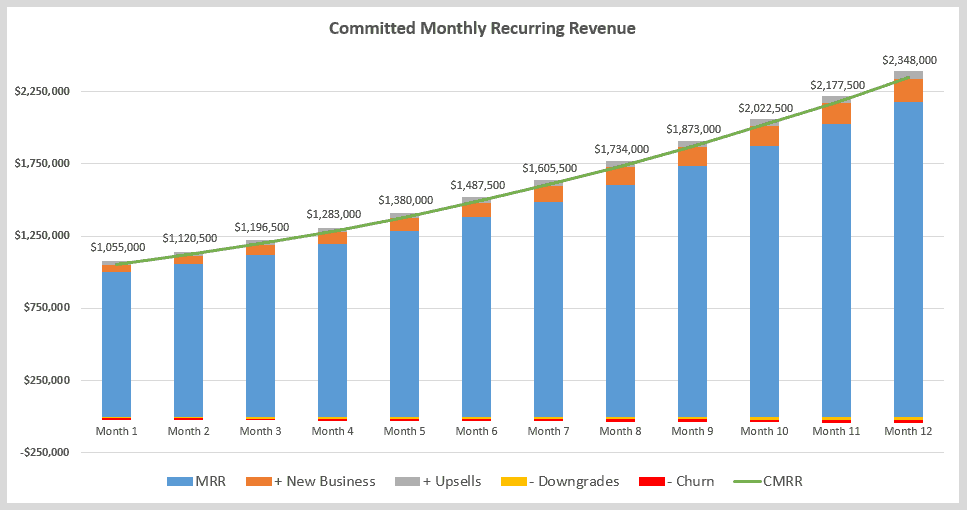

Forecasted CMRR

If you are forecasting your financials (if not, download my SaaS Financial Plan), you can also forecast your CMRR or CARR by month. Since SaaS companies are often valued by a multiple of ARR, forecasting your CMRR or CARR provides insight into future valuations based on the growth of your ARR. I also like to see my exit rate or book of business that carries over into each new fiscal year.

Conclusion

With your bookings and MRR data, you can easily calculate your committed monthly recurring revenue (CMRR). Use CMRR to understand the net inflow or outflow of MRR or ARR to business which provides more insight than just publishing new business bookings. And make sure you track every type of bookings. It will save you a lot of time in the future.

CMRR has been added to my SaaS Metrics file if you would like to download the equation and charts.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Ben,

How do you incorporate a signed contract that builds over time? Let’s say you are selling seat licenses and the customer contracts for 100 seats at $100 per month but want to roll it out over time. For this example let’s assume 10 seats per month. Month one MRR is $1,000 scaling linearly to $10,000 MRR over 10 months. Excluding churn, downgrades and upgrades, but once the deal has been contracted, is the CMRR $1,000 or $10,000?

Thank you, in advance.

Caleb

Hi Caleb,

Thanks for the question. Great question. I view CMRR as a point in time measure. However, you do want to receive credit for future known expansion and not just expansion happening at the point of measurement. I would just add another line item to this formula for contract future expansion and make sure your team understands how you are calculating CMRR.

Ben

Hi Ben,

Great post, thank you ! I have one question regarding churn, how do you account for it ?

Example: I’m on March 31st and I’m looking to calculate my cMRR for March. I add new & expansion bookings to the MRR of February – all clear.

Now let’s assume that Customer A was a paying customer in February, came up for renewal in March, but decided not to nenew. I should count him as a March churn, right ?

Now Customer B, was also a paying customer, will be coming for renewal in June, but tells me on March 15th “hey, just wanted to let you know that I won’t be renewing my subscription in June”. What do I do with customer B ? Shall I count him as a March churn ?

In summary: how do you account for “known churn”? From the moment that they give you notice that they won’t be renewing? Or from the moment their subscription actually stops? This is an important question for enterprise companies that have large contracts (where customers have to give you notice several months in advance to tell whether they are going to renew or not)

Thank you !

Guillaume

Hey Ben, how do you find downgrade bookings?