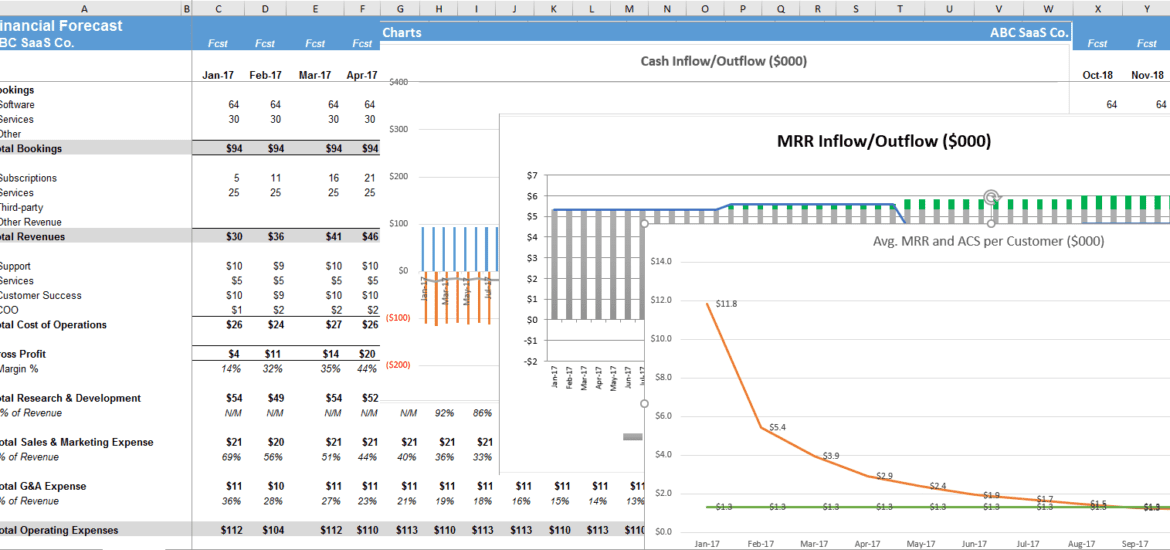

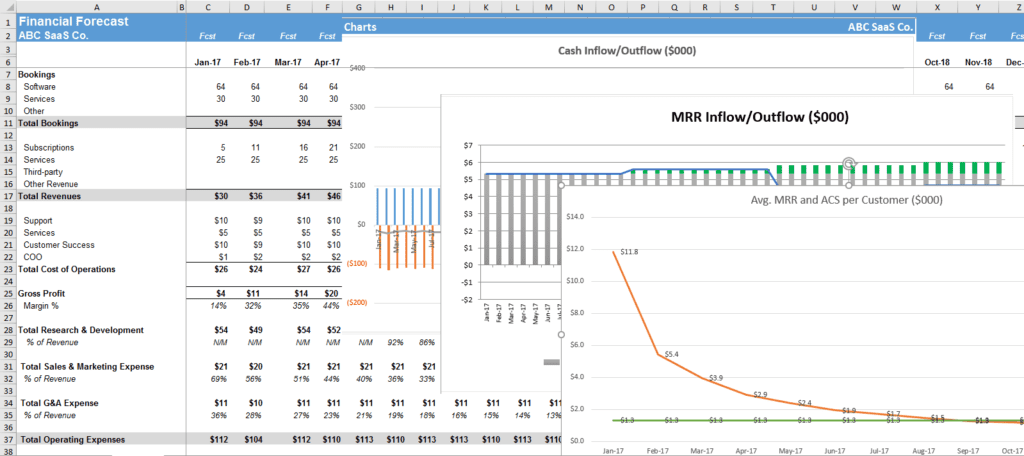

SaaS Financial Plan for Startups and SMB’s

I created the SaaS Financial Plan in Excel, so that SaaS startups and SMB’s could easily create their own financial forecast. Many Excel forecast models become very complex, but I created step-by-step instructions with links to input cells so you can easily create your first forecast.

I am constantly improving and updating my SaaS financial model with more metrics, charts, and features. Please bookmark this page and check back for the latest version. I would love to hear your feedback.

Release versions are below with comments. You can download the latest SaaS Financial Plan below.

Version 1.0

- Initial release

Version 1.1

- Expanded CapEx forecasting to include book depreciation forecast and tax depreciation forecast.

Version 1.2

- Expanded Revenue Inputs tab to include Field Services revenue, bookings and backlog forecast.

- P&L now includes a forecasted Services revenue line

- New charts include Cash Balance, Customer Counts, Services Backlog and Backlog in Months

Version 1.21

- Small but major fix to pull in the correct cash amount. In row 63 on the Summary tab, I was not pulling in Services bookings into cash. Added this.

Version 1.3

- Headcount model can forecast more than one position per row.

- Added CAC and customer acquistion costs on the Summary tab.

- Fixed the services burn formula on the Revenue Inputs tab.

- Added Charts – 1 Year tab.

- Added Saas Magic Number calculation to Summary tab.

Version 1.31

- Fixed Services Burn formula on Revenue Inputs tab.

Version 1.32

- Revenue Inputs tab can toggle between MRR and ARR model

- Added CAC Payback Period formula on Summary tab

- Added CLTV formula on Summary tab and related charts

- Added SaaS Magic Number charts

- Added Cost of $1 of New ACV calculation and related charts

Version 1.33

- Fixed formulas in cells B14 to M14 in Revenue Inputs tab. It was not calculating ARR customer renewal counts correctly if you started with a beginning customer balance.

Version 1.34

- Improved the accuracy and flexibility of the MRR waterfall on the Revenue Inputs tab

- Previously, it could not handle renewals and new ARR/MRR starting at different price points.

- Improved accuracy of renewal averages (weighted average of new and existing subscriptions).

Version 1.35

- Fixed terminal value calculation on Summary tab. It was not discounting by WACC.

Version 1.36

- Created a Revenue Summary tab so that it is easy to add multiple revenue input tabs.

Version 1.37

- Fixed formula in row 36 of Revenue inputs tab. Formula was lagging behind one year in capturing expansion revenue.

- Improved formula in row 24 of Revenue inputs tab. If you started your customer count later than month one, you would see #DIV/0! errors.

Version 1.38

- On revenue tab, fixed cell B27 to account for ARR or MRR. This is a manual input cell, but I do have a formula there for a quick calculation.

Version 1.39

- Fixed formula in cell B14 on revenue tabs. Formula referencing a cell with no number which affected timing of renewals.

- Deleted CapEx and MACRS tabs. Too complex for this model.

- Fixed CLTV formula on Summary tab. Not pulling in ARR from Revenue Input Tab B.

- I have begun to put all SaaS metrics calculations from the Summary tab on to their own tab for clarity (see LTV tab as an example).

Version 1.40

- In the Revenue Inputs tab row 36, I added an Expansion MRR/ARR calculation. Rows 8 and 9 in the Revenue Summary tab were not calculating bookings correctly if you are on an MRR basis.

Version 1.41

- In version 1.40, there was a #REF error on row 55 of the Summary tab. In a previous version, I deleted the CapEx tab but did not delete where the CapEx number was being used. This did not affect the P&L forecast.

Version 1.50

- Big changes to the SaaS metrics calculations in version 1.50. Rather than jam a bunch of formulas into one cell, I created a tab for each SaaS metric so that you can clearly see the inputs and calculation. I also added SaaS benchmarks to the charts so that you can see how your business compares to the Key Banc SaaS Survey.

Version 1.51

- Fixed CAC Payback Period calculation on CAC Payback Period tab. Formula had CAC in denominator rather than in numerator.

Version 1.52

- Fixed formulas in rows 86 and 87 in Revenue Summary tab.

Version 1.60

- MAJOR UPDATE – now includes Actual section so that you can include actual historical data in your P&L and SaaS metrics.

Please download v1.60 via the button below. You’ll receive an email with the download link.

Click here to check out my free video lesson on how to use the SaaS Financial Plan.

The course is part of my newly launched SaaS Academy.