In the SaaS space, we talk a lot about the health of our recurring revenue. This comes in the form of churn and retention. And it makes sense, right? Macro level valuations of your SaaS business are based on a multiple of recurring revenue.

But as an operator of your business or an investor in SaaS, you need to understand more than the headline ARR number; you need to understand the layers of recurring revenue and the health of that recurring revenue. Not just aggregate numbers but cohort level analysis.

In a previous post, I discussed in detail the cohort analysis framework and how to apply it to your business. However, cohort analysis is not for the faint of heart. It requires very specific data and monthly tracking. Hence, the need for a framework to organize and analyze that data.

But sophisticated analysis is not built overnight. If you are not ready for full-blown cohort analysis, we can step into the health of our recurring revenue by implementing the renewal rate metric and the upsell rate metric.

In this post, I will explain how to calculate these metrics and apply them to your SaaS business. I will also introduce the hidden renewal danger within multi-year contracts which goes hand-in-hand with renewal rate discussions.

Plus you can download my PDF guide below.

Renewal Rate

You would think that a single revenue stream such as recurring revenue would be easy to understand. Yet, there are so many factors, variables, and nuances that make up our main source of revenue.

The renewal rate tracks churn and retention down to the month of invoicing. Rather than track churn and renewals against your total customer count, you track renewals based on each cohort of monthly invoices.

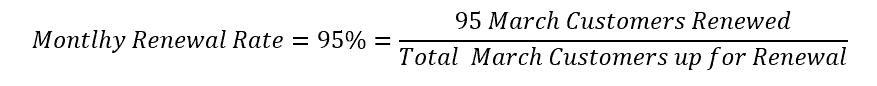

For example, if I send out one hundred invoices for Jan-XX renewals, I track who paid their invoice and who churned against the Jan-XX renewals, not against my total customer count. If five customers churned, my Jan-XX renewal rate is 95% (95 renewed / 100 invoiced customers). Every month you continue this renewal rate tracking process.

Benefits of the Renewal Rate

Although the renewal rate is somewhat of a historical metric, it may help identify an early downward trend in renewals. The downward trend may be masked when tracking only aggregate churn and retention. It’s much easier to identify a pattern when isolating the five customers churning out of one hundred customers in Jan-XX versus five customers churning out of one thousand total customers.

Also, organizing your renewals by month benefits your account management and customer success teams. These teams can gain forward visibility on upcoming renewals by month and the historical renewal trends. Each team can prepare for upcoming renewal discussions and/or potential customer expansion opportunities.

How to Calculate Your Renewal Rate

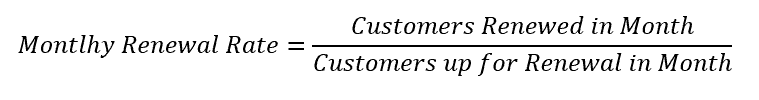

The renewal rate focuses on just on the renewals due in a single month. For example, if you just processed your Mar-19 renewals, you will focus on the total number of customers due for renewal in Mar-19 and the total number of customers who paid their invoice.

To calculate your renewal rate, you simply divide the number of customers who paid their invoice by the total number of customers invoiced.

Cohorts within the Renewal Rate

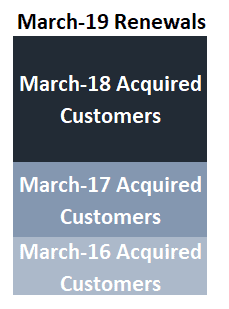

Now that we are tracking our monthly renewal rate, there is additional data that we can extract from this metric to enhance it. Within each batch of monthly renewals, there are many subsets or cohorts of customers. In our Mar-19 example above, the March renewal customers are composed of customers acquired in Mar-18, Mar-17, Mar-16 and so on.

As you can see, a single month of renewed customers is a blend of customers. So much of blend that you could argue that the monthly renewal rate metric is just too generic and backward-looking.

To make the renewal rate more powerful and predictive, Stephen Wolfe, co-founder of Growth Street Partners, suggests that we use a new SaaS metric that he coined as the Upsell Rate.

Upsell Rate

Stephen defines Upsell Rate as the percentage of customers within a cohort that purchases additional software or services (i.e., the # of customers that purchased more in the cohort divided by the total number of customers in a cohort). This is upsell rate on a logo basis.

Growth Street believes that the renewal rate is mostly backward looking. To enhance the effectiveness of the upsell rate, he argues that we should try to be more predictive with our upcoming renewals.

For example, if we had two cohorts both with 95% renewal rates, it would be natural to assume that each cohort would renew at similar rates in the future. But what if one cohort has a 5% upsell rate, and the other has a 20% upsell rate? Which cohort would have a higher renewal rate in the future

Yes, the cohort with a 20% renewal rate. This cohort contains customers who are expanding usage of our product and thus more likely to be happy and renewable. The upsell rate gets even more interesting when you measure the upsell rate on an ARR basis.

Upsell Rate Based on ARR

Like other retention metrics, we can calculate the upsell rate based on logos as described above and dollars.

Let’s say cohort A contains ten customers. Nine customers are at $10K ARR and one customer is at $50K ARR. The $50K customer was recently upsold. Let’s consider cohort B with another ten customers but they are all at $10K ARR. Only one customer was upsold.

For cohort A, the upsell rate on a logo basis is 10% (1/10). On a dollar basis, it is 36% ($50/$140). For cohort B, the logo upsell rate is also 10% (1/10), but the dollar upsell rate is also 10% ($10/$100). In this example, the upsell rate based on dollars is more accurate. Again, like other metrics, you will want to calculate it both ways to better understand the nuances in your customer cohorts.

The Importance of the Upsell Rate

So why should we go through all of this math? I argue that SaaS metrics become much more powerful when used in context with other metrics. In this case, the upsell rate provides additional insight when contemplating the meaning and direction of your monthly renewal rates.

The upsell rate also provides important information for your account management and customer success teams. Your customer success team’s focus can be applied to those cohorts with low upsell rates so that they can be more proactive with potential churn. Your account management team can focus on cohorts that have not recently purchased additional product.

The upsell rate can also improve your annual budget process. Forecasted retention rates can be a big swing factor on future cash flow. For example, 5% ARR churn on a $10M business can create a ~$500K reduction (assuming minimal expenses tied to that ARR) in your ending cash balance.

One way to pressure test your renewal assumptions is to segment your expected renewals for the year into two groups: 1) those who have upsold and 2) those who have not upsold. Then, see what happens to your budget when you apply a high churn rate to the second bucket. This analysis will show you an expected burn rate in a bear case renewal situation.

Multi-year Contracts and Renewal Rates

One dangerous assumption that lurks in your aggregate churn and retention metrics involves multi-year contracts. I had not really considered this variable until it surfaced in a due diligence request. And it’s a very sharp question.

If you primarily sell multi-year contracts, we know that customers do not come up for contract renewal each year. You may “renew” them by sending them an invoice for contract year two of three, for example, but they are obligated to pay under the terms of your master agreement.

If you are touting 95% aggregate annual retention rates, what is the actual retention rate when you count only the customers who have the choice not to renew? That 95% retention rate may be artificially supported by customers who are locked into multi-year contracts and have no choice but to renew.

You’ll get an idea of this hidden danger within your aggregate numbers by comparing your monthly renewal rates against your aggregate retention rate. If your monthly renewal rate is lower than your aggregate retention rate, it could be influenced by the number of customers locked into long-term contracts.

Knowing the segments of customers who are and are not locked into contracts can help focus your sales and customer success teams. It also gives you a more accurate view of retention and renewal rates.

Action Plan

The health of our recurring revenue is vital to understand. And it’s just so much more fun when we can make proactive decisions around improving our business.

If you are not ready for cohort analysis, begin tracking your monthly renewal rate. It’s as simple as asking your accountant for the list of customers who are receiving their next annual or multi-period invoice. Track who paid and who did not.

Then you can further segment that list by applying the upsell rate. Identify the distinct cohorts within your monthly list based on acquisition year. Within each cohort or subset, identify the customers that have been recently upsold. Use the upsell rate to home in on the customer cohorts who may be at risk for renewing.

Do you track your renewal and upsell rate? I would love to hear your comments below.

Download

Download my free Renewal Rate guide below.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

This is a really nice article. Another way I cohort renewal rates is by how many modules a customer is currently on. If they are “full program” we have can’t upsell them but we know the churn is almost 0. We also look at certain metrics of activity/use as well.

One other way I think about this is what happens at the time of renewal (expansion/contraction) and what happens inside a contracted period (an upsell). Operationally, this lets you track net dollar retention for just renewals in a period vs what is upsold in a period for the rest of the “book of business”

We are going to start tracking renewal on yearly and upsells straight away. Thanks for this article Ben.

Does a price increase on an annual renewal fall into ARR or Net New ARR or does it depend on how the company wants to recognize it?

Hi James, prices increases if contracted, yes, I include as net expansion. But if it is price inflator via your master services agreement, then I don’t include that as a booking.