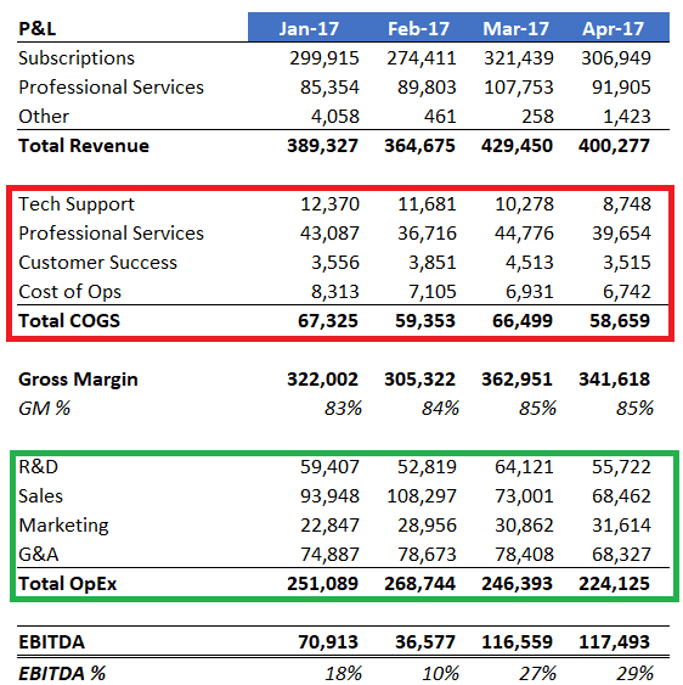

When I review a SaaS P&L for the first time, I take a high-level approach to understand the financial health of the business. I break the P&L into two sections, the “top half” and the “bottom half.”

The top half contains revenue, COGS departments and our gross profit. The bottom half contains our operating expenses (OpEx). Revenue and margins receive a lot of attention, but it’s just as important to understand the economics of our operating expenses.

Operating expenses are the expenses below gross profit that support the infrastructure, growth, and continued development of our business model.

We must understand how our operating expenses move with revenue. Do we have the necessary amount of investment to support the growth and stability of our business? Will we create operating leverage over time?

Post Updated: April 2025

Your OpEx Profile

In SaaS, operating expense departments include R&D, sales, marketing, and G&A (HR, IT, finance, accounting, legal). Whenever I read a set of historical or forecasted financials, I like to calculate the department’s expense as a percent of revenue.

As a percent of revenue, you can understand the investment the organization is making into the department. You can also benchmark that percentage against your SaaS peers.

Just like revenue and bookings targets, we must also have targets in mind for our OpEx profile. I’m a proponent of doing this for R&D and G&A. However, sales and marketing as a percent of revenue does not tell me much. With sales and marketing, I’ll refer to the related go-to-market efficiency SaaS metrics to understand the investment and efficiency in our sales cycle.

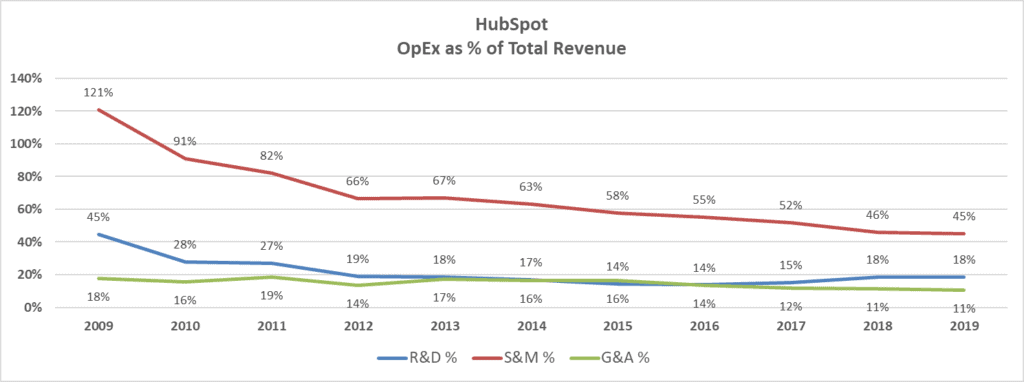

HubSpot’s OpEx Profile

To see an OpEx profile in action, check out Hubspot’s profile from pre-IPO to post-IPO. In the early days, you can see a lot of investment in sales/marketing and R&D as a % of revenue. G&A was actually in good shape. Often you see G&A around 30%+ in the early days.

As Hubspot scaled, it became more efficient as a percent of revenue over time. You should run this same exercise for your SaaS business. What direction are your percentages moving?

SaaS OpEx Benchmarks

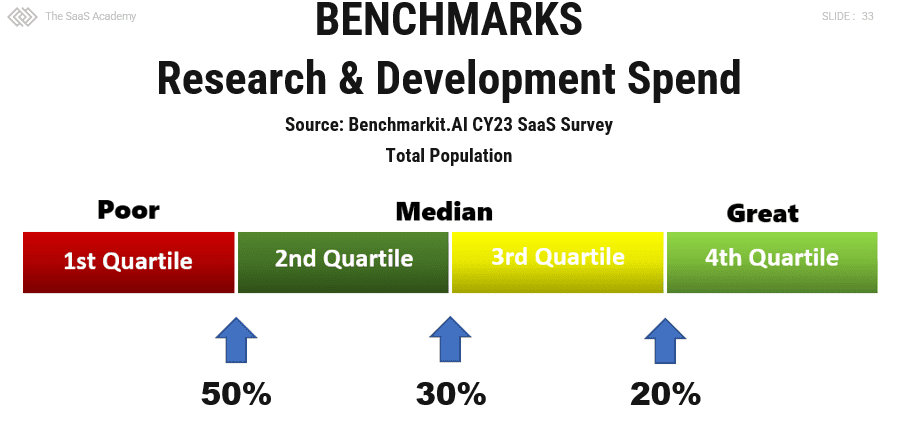

My go-to source for SaaS benchmarks is Benchmarkit.ai. I’m using Ray’s data below to show you the high-level OpEx benchmarks. For my SaaS client base and in my SaaS Metrics Foundation course, I show you to segment these benchmarks further.

For OpEx benchmarks, I like to benchmark by ARR size.

R&D OpEx Benchmarks

In the chart below, I’m presenting the R&D benchmark spend for the total population of SaaS companies in Ray’s data. Again, we should benchmark our business by ARR size. Go to Benchmarkit’s site to grab your custom benchmarks for free.

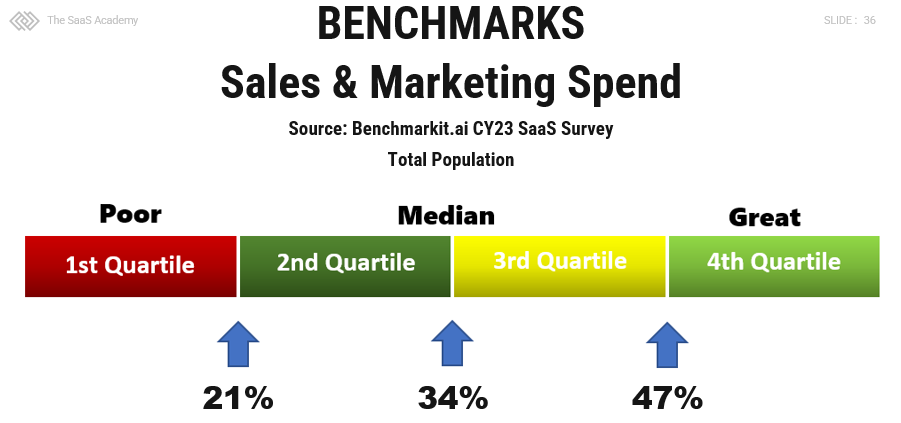

S&M OpEx Benchmarks

S&M as a percentage of revenue does NOT tell us the efficiency of our GTM team. It only tells us how much we are investing in growth.

When I see this under 10%, it’s usually still founder-led sales.

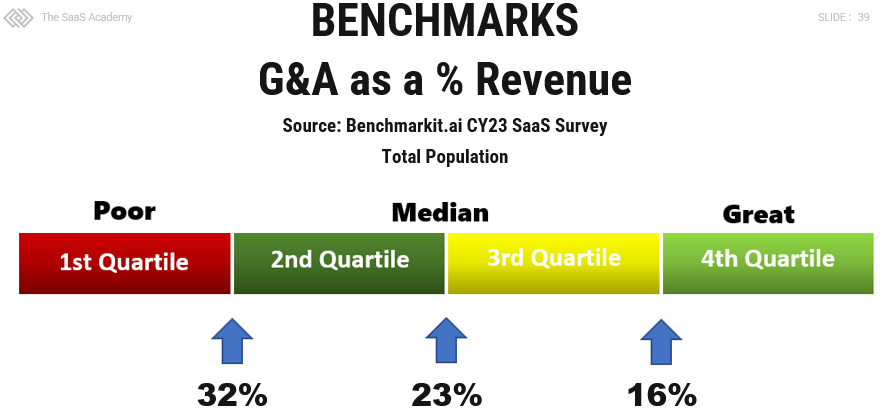

G&A OpEx Benchmarks

Here’s where I live as I a CFO. It’s my responsibility to scale the back office efficiently. If you are running high here and you are the CFO, it reflects on you.

Usually, I see this run above 30% and then scale down as you grow.

Expectations of SaaS OpEx

OpEx follows a pattern. It will scale down as a percentage over time. This is where we create operating leverage and unlock cash flow.

- Act like fixed expenses

- Continue to invest! But expect efficiency as a percent of revenue over time

- Easy to get caught in “growth trap.” Gross profit increases but we spend at the same pace in OpEx

- Keep your financial profile in mind as you invest and scale

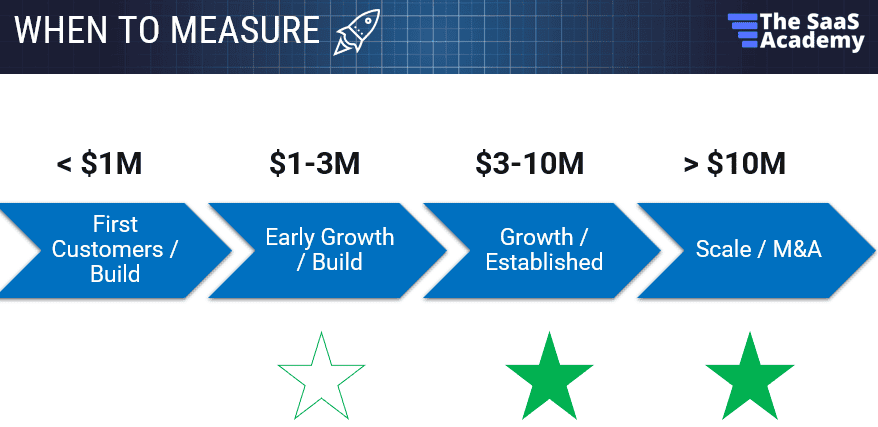

When to Calculate Your SaaS OpEx Profile

I start to see the OpEx profile taking shape around $5M ARR. It’s always hard to put ARR targets on this, but above $5M ARR, we should be calculating our OpEx profile and benchmarking it with Ray’s data.

Additional Resources

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 9+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.