SaaS Startup Financial Model

Based on feedback from users of my SaaS Financial Plan, I created a new SaaS Startup Financial Model in Excel intended for founders and non-spreadsheet jockeys. I scaled down my original SaaS financial model in an attempt to make it easier for SaaS founders to productively use my model.

Intended for: Founders, beginner Excel users

Early-stage SaaS companies typically do not have a finance pro on staff, but founders find themselves spending a lot of precious time building a financial forecast themselves. I tried to cut out any fluff and cut down on the amount of sheer numbers presented in the forecast model.

All SaaS financial metrics are removed since you probably don’t have the volume yet for those metrics to be meaningful. It’s more about cash flow and go-to-market strategies.

The following tabs are included in the model to help you with your first forecast.

Download the Excel model at the bottom of this page.

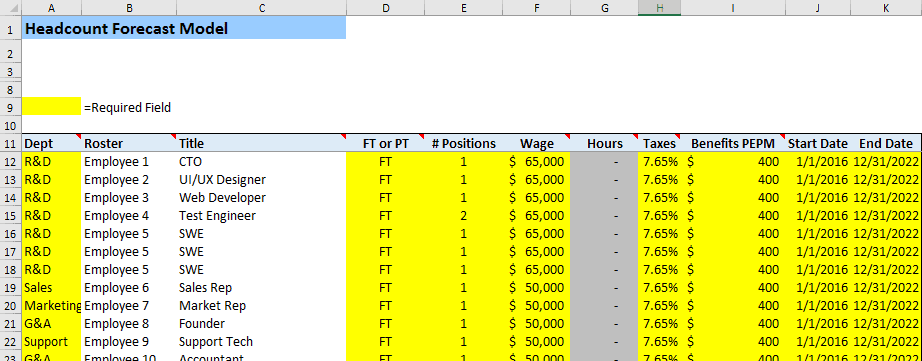

Headcount Planning

The headcount planning tab allows you to input the details of your headcount roster. For example, title, wage, benefits, taxes, etc.

The really nice feature is that you can specify the start and end date for each position and the headcount planning formulas take over. You’ll have a wage forecast in no time.

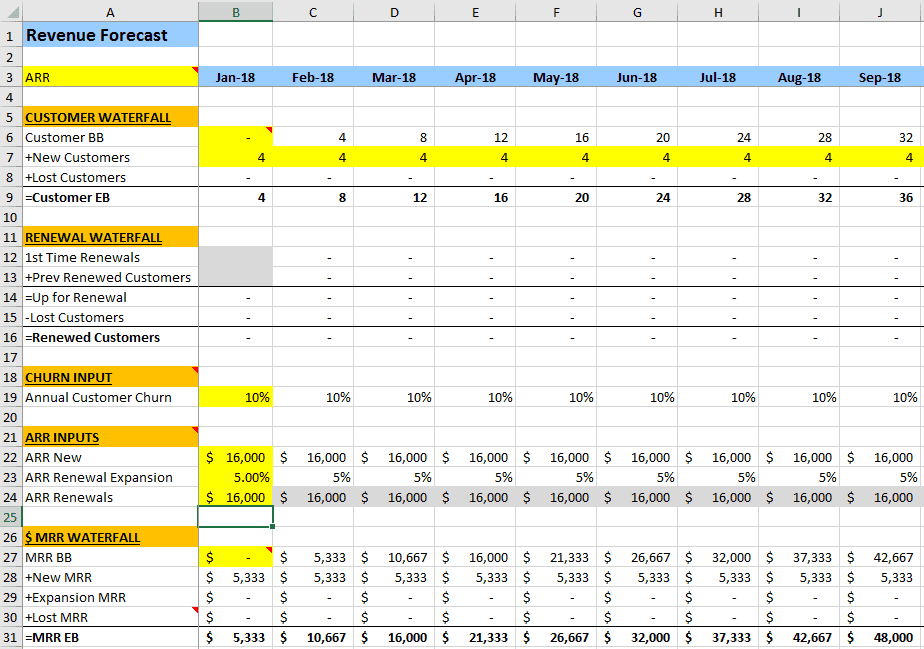

Recurring Revenue Model

For SaaS businesses, recurring revenue is the core of your existence (and valuation). The recurring revenue forecast tab requires a few key inputs. These include new customer counts, churn, revenue expansion, and professional services assumptions (if any).

After you have inputted these numbers, you’ll have a nice monthly recurring revenue forecast, or waterfall as I like to call it. It’s set up to handle ARR or MRR subscription businesses.

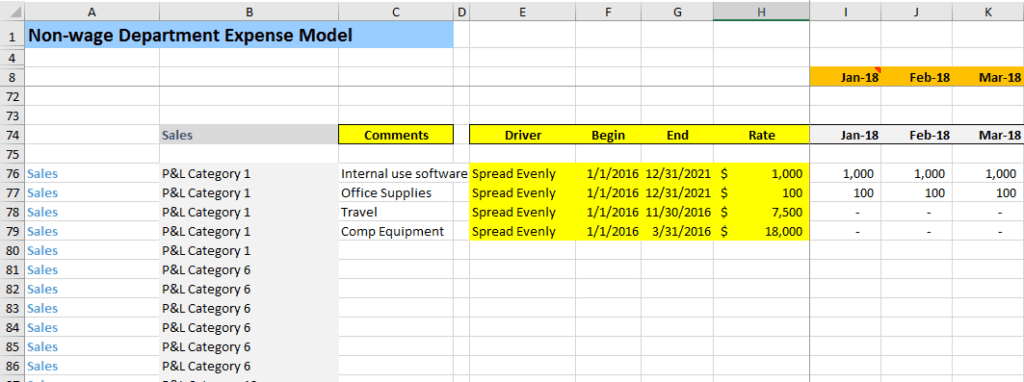

Operating Expense Model

Now that you have forecasted your headcount and wage costs, you can focus on non-wage expenses such as commissions, travel, rent, and professional services (for example, CPA’s, lawyers, consultants, etc.).

Those are the most common expenses that I see in early-stage SaaS startups. I include formula examples that do the work for you, so that you are not inputting numbers month-by-month, row-by-row.

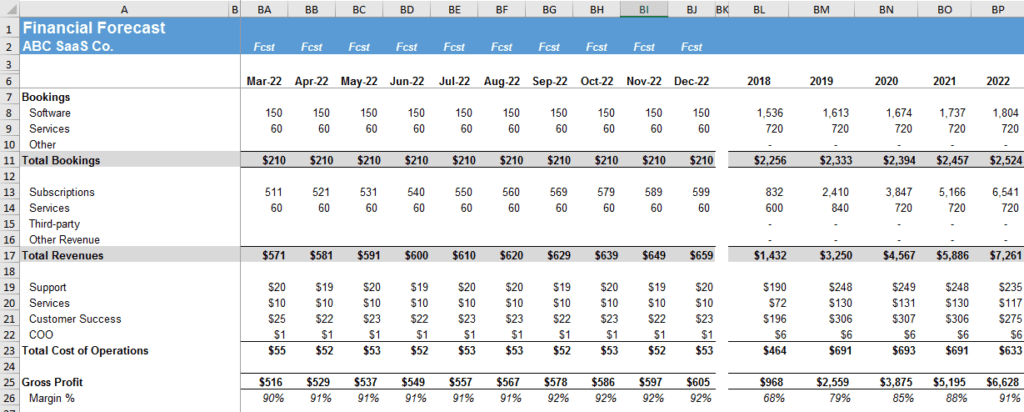

SaaS P&L Template

Finally! We now have the financial output in an accepted SaaS P&L template. This includes the proper grouping of department expenses, so that you see your correct SaaS gross margin and operating expenses. The output also includes your headcount forecast and high-level financial metrics.

Please contact me with your questions, feedback, and comments! Download button just below.