The cost of customer acquisition is one of the most analyzed SaaS metrics. But it doesn’t have to be complex or hard to calculate. Enter the SaaS CAC Ratio.

Slightly different than CAC (customer acquisition costs), the CAC ratio studies the relationship between new and expansion bookings and sales and marketing expense. It’s different than CAC, because CAC calculates the cost to acquire one new logo. The CAC ratio focuses on the cost to acquire annualized recurring revenue (ARR). It puts the cost on a dollar basis rather than a logo basis.

It’s one of my favorite SaaS metrics for several reasons. It requires just two inputs, and it’s easy to calculate. Also, there is great data available to benchmark your performance against SaaS peers.

The CAC ratio is also referred to as the Cost of ARR (annual recurring revenue).

The Four Forms of the CAC Ratio

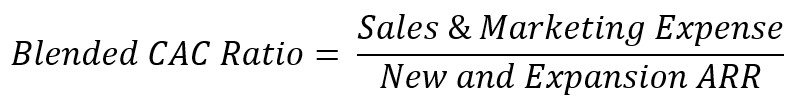

There are four ways to calculate the CAC ratio. First, we have the blended CAC ratio. The blended ratio calculates the cost of all new ARR whether it comes from new customers, expansion, and/or upsell.

Second, we have the new customer CAC ratio. As the name suggests, it’s the cost to acquire ARR from new business only (i.e. new customers).

For the final two formulas, we have the expansion CAC ratio and the upsell CAC ratio. These metrics are calculated the same way, but expansion CAC is defined as expanding sales of existing products to existing customers. And upsell is defined as selling additional products or modules to existing customers.

When referring to “expansion” below, I’m including both expansion and upsell.

How to Calculate the CAC Ratio

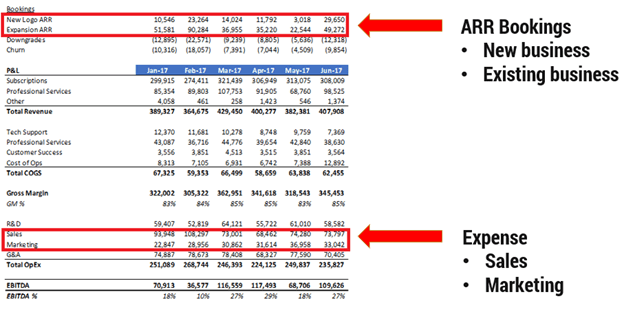

Let’s start with our blended CAC ratio. The blended CAC ratio requires two inputs, new and expansion ARR and sales and marketing expense.

In the denominator, we have new and expansion ARR. Your ARR data can typically be pulled from your CRM software. I live in the ARR world, so I often refer to contracted ARR as a booking. A booking is an executed contract for software and/or services between you and your customer.

For SaaS companies with lower price points and online customer sign ups, your bookings will be MRR (monthly recurring revenue) from new sign ups and customers who are expanding their MRR footprint via new modules, added users, etc.

In the numerator, we have our fully burdened sales and marketing expense. When I say fully burdened, this means all operating expense associating with these two cost centers. Not just wages or not just paid ads. Every expense that originates from the sales and marketing departments. See below for the major expense categories typical in these departments.

Sales and Marketing Expense

- Wages, taxes, and benefits

- Commissions

- Travel

- Conference/trade show expense

- Paid media

- Training

- Software

- And on…

New Customer CAC Ratio

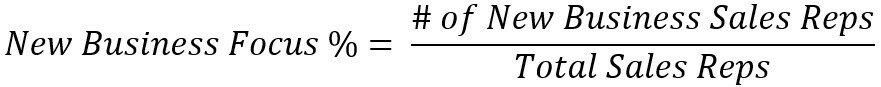

The new customer CAC ratio follows the same formula as above with two caveats. We now only include ARR from new customers, not expansion business. This means that we must allocate our sales and marketing expense between new business and existing business acquisition.

To allocate your sales expense, I recommend the ratio between new and existing sales reps as the percentage allocation factor. If you rely on inbound sales only and do not have new business reps, you will have to review the operating expenses within your sales department to determine the intent of those expenses and allocate accordingly.

The allocation of your marketing department can be trickier. I would talk to your marketing leader to gauge her efforts in new versus existing business acquisition. And look at your marketing expense to determine new customer acquisition intent versus targeting your existing customer base.

Again, we have the familiar CAC ratio formula below, but the sales and marketing expense is the allocated portion of the total sales and marketing expense dedicated to new business acquisition. New ARR is just ARR from new customers, no expansion.

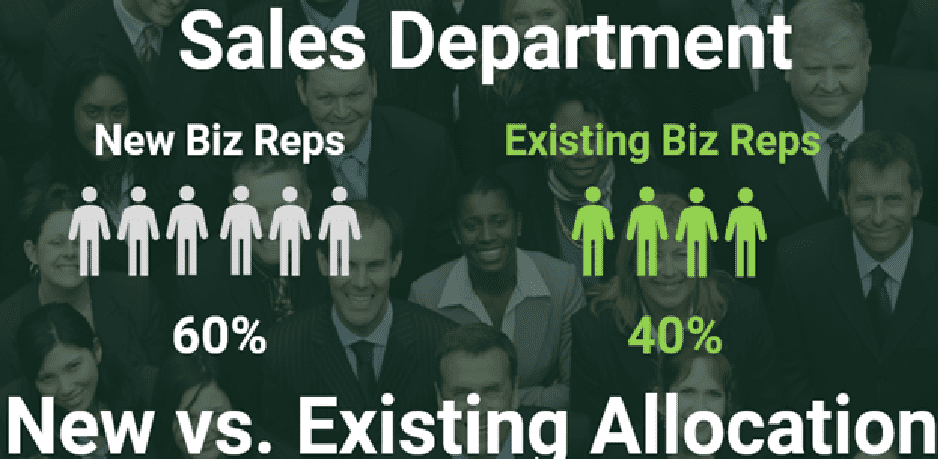

Expansion CAC Ratio

With the expansion CAC ratio, we include all expansion ARR. This includes cross sell and upsell. Of course, if you track cross sell and upsell separately in your CRM data, you could also calculate these ratios individually. Remember, do not include new customer ARR in the ARR number below.

Again, you need to follow the same allocation methodology described above. This time you will allocate the total expense in sales and marketing dedicated to expanding existing business.

Time Period to Measure

When measuring acquisition costs, I like to measure a time period that is equivalent to your sales cycle. For example, if your sales cycle is four months, I’ll pull the last four months of ARR and sales and marketing expense.

I will then continue to calculate this metric on the trailing four months, for example. Your measurement period equals your sales cycle length.

If you target enterprise customers and have a long sales cycle, you may consider lagging your marketing expenses. The deal that closed today is most likely from a lead generated by marketing from a year or more ago, for example. Use marketing expenses from a period that represents when the lead was generated.

When to Measure the CAC Ratio

I would begin to calculate this metric when you move past the early adoption phase and begin to allocate real budget dollars towards customer acquisition. Under the Growth / Build stage below, I indicate that you should begin to measure the CAC ratio.

The green outlined arrow means that you should begin to calculate this metric somewhere in this phase. The completely green star means that you should be monitoring this SaaS metric.

Why is the CAC Ratio Important to Measure in SaaS?

The cost of revenue acquisition is critical to SaaS businesses. Spend too much and it may take a long time to payback your customer acquisition costs. If payback periods are too long, CAC ties up a lot of working capital. And if churn is high, inefficiency eats your cash and EBITDA margins.

I like to compare CAC to debt. If the customer churns prior to your CAC payback period, it doesn’t mean that those CAC dollars disappear. It puts more burden on your future customer acquisition.

If your CAC ratio is efficient, you can then allocate additional resources to accelerate your revenue growth.

The Required Data to Calculate the CAC Ratio

This metric is straightforward to implement in your monthly reporting package. Your ARR or bookings data is sourced from your CRM software. Your sales and marketing expenses will be pulled directly from your SaaS P&L.

Action Items

Implement the CAC ratio into your monthly financial package. The calculation requires two major inputs which are readily available in your CRM data and your SaaS P&L. Measure the metric over a time period that equates to the length of your sales cycle.

Benchmark your acquisition against SaaS peers by downloading the KeyBanc SaaS Survey. The CAC ratio is not just backward looking. Make sure you forecast your ratio to understand how your bookings growth balances with your sales and marketing spend.

Free Download

Suggest Reading

- The SaaS P&L – how to correctly structure your P&L

- CAC Payback Period – how to calculate this important metric

- CAC – how to calculate your customer acquisition costs

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Not sure I understand your comment under Time to Measure where you say pull last four months of ARR and sales and marketing expense, assuming 4 month sales cycle. Seems to me the months of ARR and sales and marketing expenses are mis-matched. In this scenario, I have used the following calculation:

Assume $20,000 of new ARR in May and Jan to April sales and marketing expense of $5,000 per month. With a 4 month sales cycle, presumably 25% of each month’s sales and marketing expense is being utilized to generate the new ARR in May. Thus the CAC for new May ARR would be $5,000 per month times 25% allocation times 4 months or $5,000. This results in a CAC ratio of 0.25 ($5,000 / $20,000).

Thoughts?

Hi Larry, thanks for the question. The idea is to match your measurement period to your sales cycles. I think you might be getting at the lag between the effort and when you book the ARR. For very long sales cycles, 12+ months, you might want to lag the calculation for your marketing expense b/c it takes some time for those leads to close. Also, yes, when looking at New Business CAC Ratio, you do have to allocate your sales and marketing expense that is dedicated to new business acquisition.

Hey Ben,

Tagging onto Larry’s question, I was focused on the same item: Time to Measure. I think the way you have it here can lead to very misinformed decisions.

From a Marketing perspective, expenses don’t necessarily match up to the sales cycle or outcomes, for that matter. For instance, if I plan to attend a trade show in September, I may have to reserve my booth, rooms, and floorspace by making deposits in January, and then again in June. If I’m measuring my results in December, these costs were incurred outside of the window of time being measured.

For this very reason, Marketing budgeting and outcome reporting becomes more of a science and art. I would use a TTM model and create snapshots of MoM/QoQ/YoY performance to highlight the real activity. Then I would measure funnel creation, CAC, LTV, etc. on a blended level, and then drill down into the different segments and channels being utilized to look at effectiveness and efficiency. Does this make sense?

Hi Mark, yes, that’s exactly the point. You don’t want to measure new bookings in December and match that against expenses from December only or the fourth quarter. I measure based on a rolling period that matches my sales cycles. Again, the time period measured for ARR and expense should sync. If you have a very long sales cycle, you may want to “lag” marketing expenses b/c there is a delay from lead creation in marketing to the closed won deal (if you are mid-market or enterprise). Different, if it’s just swipe a credit card and start using the software.

One note, though. If you are making large deposits in a time period that is far from the actual trade show, you may want your accountant to book that to deposits or pre-paids (balance sheet only). Then expense it at the time when the expense is incurred.

Every business is a different so you may need to customize the inputs, time periods, etc to align with your business model and how you measure the economics of your business. Great points.

Ben,

What’s the rationale to use the new Sales reps mix of total sales reps for “New Business Focus %”? Don’t existing reps sell to new logos? I wonder if this may end up inflating new Customer CAC ratio as newer sales reps are likely to be less productive as well and this credits them for new business that existing reps land.

Hi Cyrous,

Great question. It really just depends on your sales team makeup. I’ve worked in SaaS companies where we had dedicated sales reps going after new business only. And then account executives going after the expansion of existing customers. It’s easily to allocate based on the new versus existing mix. You just have to determine the best way to allocate based on the effort to acquire new versus existing business.

Ben

Ben – thanks for the article, it is very helpful. My questions are around App Store fees that are incurred as part of the sale. Ques 1: Do you include App Store charges as a ‘Sales’ expense? and Ques 2: Do you include it in the CAC ? Thanks, Dylan

Hi Dylan,

Great question. My gut reaction is to say COGS since that is almost like a platform expense. But I could also see it as a sales expenses. If charges with each purchase, then I would go with sales and included in CAC.

Ben

Hi Ben,

A booking is normally a 12 month contract but what if my company sells 12 month, 6 month and 3 month contracts/bookings? How should the 6 and 3 month contracts be treated for ARR purposes?

Hi Mark,

You could always track bookings on an MRR basis, but I would simply annualize the monthly value. The caveat is if you have high churn. Bookings could be slightly misleading.

Ben