Switching From One-time Sales to Subscription Pricing

Subscription pricing has become an extremely popular revenue model these days. It seems like any product or service such as wine, tea, cosmetics, or HVAC maintenance can be purchased via a subscription. One-time sales seem to be a thing of the past.

You can’t blame businesses for jumping on the subscription pricing bandwagon. Why go through all of the effort to acquire a customer and then say goodbye. It can be much easier to keep a customer than to be constantly prospecting for new customers.

How do I switch to subscription pricing?

This is a hard one. Whether subscription or one-time, pricing is both art and science. There is not one correct way to create your pricing structure. Obviously, your customer will want to pay a lower annual fee than the cost of purchasing the product or service as a one-time sale.

And this is where your business can run into trouble. If you are an existing business switching from one-time sales to subscription sales, your cash flow will experience an immediate and potentially severe impact.

Listen to a real-world example of the huge impact when Ping switched from perpetual licensing to subscription pricing. In a Nathan Latka podcast, the CEO of Ping discuss this pricing change. If you want to jump right to this discussion, start listening at the 7 minute mark.

Why is cash flow impacted?

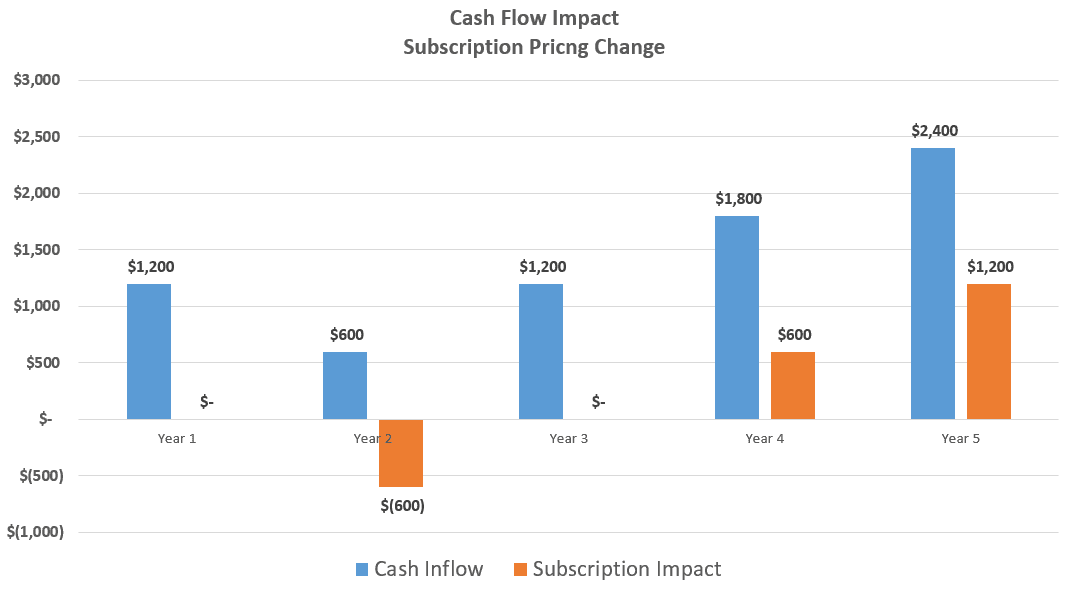

Say, for example, you were selling a service for $1,200. You receive $1,200 immediately at the time of sale. Now, you offer this same service as a subscription for $600 per year. Your cash inflow is now $600 less and it will now take two years to collect $1,200. You cash flow timing has changed.

In the chart below, year 1 follows the one-time sales model. You receive $1,200 at the time of sale. In year 2, you switch to subscription pricing and take a cash hit and your cash flow is cut in half. In year 3, you are back to status quo and in year 4 you are now benefiting from a pricing model change. This example assumes no churn.

Of course, if you keep this customer, you will earn more cash over the long run (depending on churn) than a one-time sale.

Be Prepared

Be prepared to take a cash hit when switching to a subscription model. The degree of impact will depend on your new pricing and cost structure, but I recommend modeling the financial changes to your business before making the switch.

Cash flow is king to a small business, so you must prepare your business for the timing change.

Also, you are now in the world of subscription economics. Basic financial statements will tell you the whole story. You will want to track traditional subscription or SaaS metrics such as average revenue per account (ARPA), customer acquisition costs (CAC), and average cost of service (ACS) to name a few.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

In this competitive world switching to SaaS based model is one of the right choice.

Surely SaaS will hit cashflow, but if SaaS pricing is charged on monthly basis (assuming no churn), then adding regular customer each month (assuming 1 new customer every month) will help to get best from SaaS model. So, for example: If a customer joins in January, another customer in February and so on, end of the year there will be 72 monthly billing invoices rather than looking at it yearly pricing. And to increase overall cash flow, pricing strategy can be designed using add-ons with basic subscription model to increase overall cash flow.