SaaS Revenue Forecast Model

I try to keep my financial statement models as simple as possible. I don’t forecast on one tab, but I also don’t have 30+ tabs of assumptions and formulas. I build my models around the operations of the business and the important metrics. Enough detail to be accurate and supportable but not overly done where I forget how to update the inputs with each forecast.

Revenue Forecast model can be downloaded below.

I’m positive all of us have some sort of bookings and/or revenue tab to forecast our revenue assumptions. I recently renovated one of my revenue tabs based on inspiration from Christoph Janz’s blog where he published his SaaS financial model. In this post, I am sharing my take on how I built out one my revenue tabs.

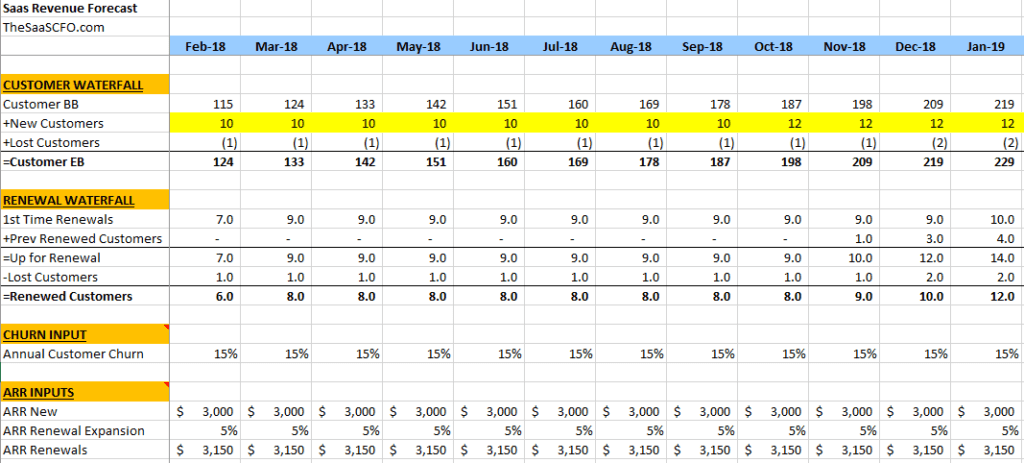

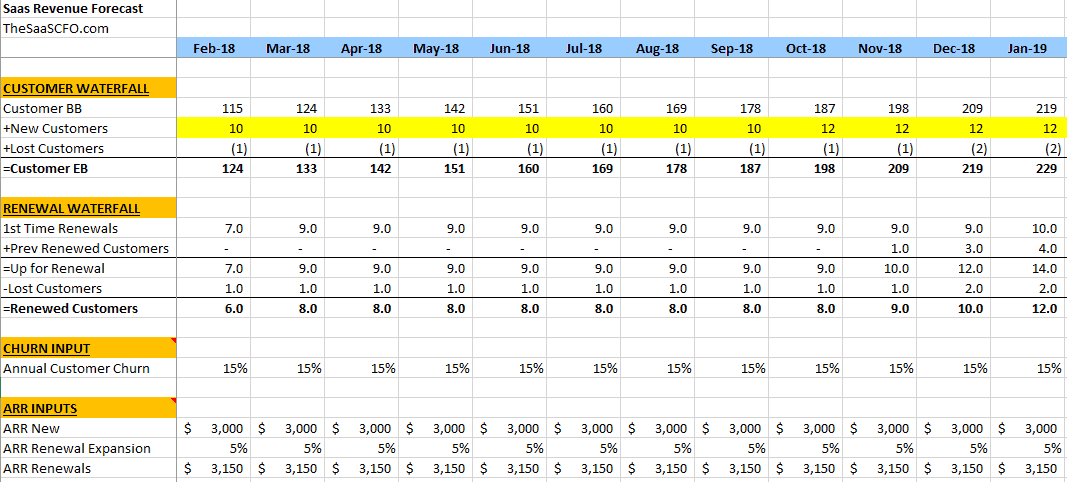

Key Inputs

This model requires only a few key assumptions so it doesn’t take long to have a complete revenue and customer forecast for your company or a product line.

- Customers

- Customer Acquisition Rate

- Churn

- Average Selling Price in MRR or ARR

- Customer Dollar Expansion

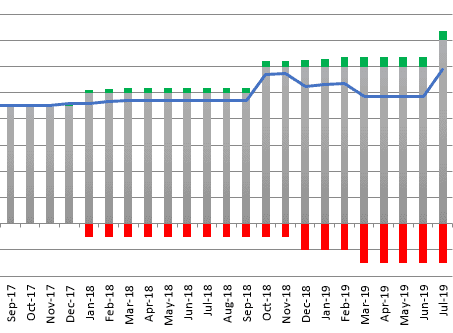

A Picture is Worth a 1000 Words

I love the MRR movement chart in Janz’s model, but I named it MRR Inflow/Outflow. At the end of the day, it’s important to know if you are incrementally net positive or negative with your subscription dollars and customer counts.

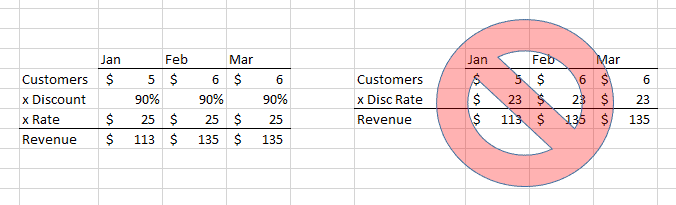

Don’t Jam a Bunch of Formulas into one Cell

On a side note, about a month ago I attended a KPMG course on corporate performance value drivers and financial statement modeling. It was an excellent course with a well-respected instructor and classmates who shared an interest in improving their finance and modeling knowledge.

Regarding Excel modeling, the instructor had a great comment about cell formulas and Excel modeling. To paraphrase, he said that if I have to click in a cell to understand the formula, then you have already lost me and your model isn’t efficient. The picture below is a simple example where just by looking at the row layout, you can tell exactly how the revenue number is being calculated.

I know that I am guilty of creating complex formulas that condense a lot of formulas into one cell. Sometimes it can’t be avoided. However, it can be difficult to then go back and understand what that cell is doing, especially if someone is inheriting your Excel model.

As always, please post any comments or questions below! Thanks, Ben.

Please enter your email address (no spam) below to download the model. I’ll keep you updated on future models and posts.

ARR version below – if you bill annually.

MRR version below – if you bill monthly.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Thanks Ben for your Amazing Work “Revenue Forecast Model”

Thank you, Muhammad, for the comment. Thanks for visiting my site.

[…] Financial Model in Excel. Over the past few months I have released various Excel models covering forecasting, SaaS metrics, and personnel expenses. I combined some of these models into one and developed […]

[…] you complete this model, you can then take the output and complete the SaaS Revenue Forecast model. Please let me know what you like and don’t like about this model. Do you currently […]

Great Model to start basing some fundamentals on. Do you recommend a hybrid for those businesses that have a mix of annual and monthly subscription customers?

Thank you.

Hi Vish,

Yes, I just released an MRR version of the revenue forecast model. In the SaaS Financial Plan model, I would insert another tab with the MRR version so that you can forecast revenue from the ARR tab and the MRR tab.

Ben

I agree that business models have to be simple and focused on key performance metrics or variables that influence the desired outcome. With this approach to business modeling, cross-functional stakeholders are also easily aligned.

[…] SaaS revenue forecast is another area where a nice, detailed model will come in handy. I have ARR and MRR versions of […]

Hi Ben – I’m currently working on an investment pitch of a public $5 billion cybersecurity company whose business model is SaaS based. I’m working on forecasting next 5 years revenue growth and was wondering methods you would use to forecast.

Should I be using a top-down approach – TAM * market penetration * # of companies, etc.. Or should I use a more granular approach by trying to forecast billings + % growth. Given that it’s a public company, a lot of metrics aren’t available. If I were to use billings, I would need to forecast revenue and deferred revenue, which again begs the question of what method to use to forecast those numbers. I’m stuck and would appreciate your opinion.

Thanks a ton.

Hi Dale,

You need to see what public data is available to help with your forecast. It’s probably going to be more high level by scaling their current financials using general assumptions (i.e revenue growth %). However, these levers will be based on external factors in the market such as competitors, market share, position in the market, etc.

Ben