Management Presentations in M&A Due Diligence

The banker said to block my calendar for management presentations. Excuse me, what are management presentations? And for two weeks?

Yes, and this is only the halfway point. The real “fun” in due diligence comes after the management presentations. However, before we get too far, let’s break down what happens at management presentations and how you can prepare your company and leadership team.

What are Management Presentations?

Management presentations are an opportunity for your leadership team to showcase your company to a handful of potential buyers that you have invited to participate in the final bidding process. You’ll meet with one bidder per day and present a complete overview of your business.

All presentations have a different flavor, but you’ll generally cover the following topics in your 50-plus slide CIM, or Confidential Information Memoranda.

- Quick facts about your company

- Market overview and total addressable market (TAM)

- Areas for revenue growth

- Your products

- Your services

- People/organization structure

- And last, but definitely not least, finance

Financials, Financials, Financials

There is a reason that I saved the last bullet for finance. Although it’s just one of many important bullets, your CFO, financials, and forecast will be stress tested during the bidding process.

From junior analysts to partners to CEO’s, all eyes will be on your historical AND forecasted financials. Laptops and calculators will be out, and they’ll be re-crunching your numbers.

It goes without saying that this is a little nerve-wracking. It’s like having your very own final exam graded, out loud, by your classmates and professor.

Tim McCormick, CEO at SaaSOptics, puts it this way, “on the tactical front, an automated order-to-payment and renewal process is vitally important to investors and acquirers. If these processes are disconnected or, or worse, tied to spreadsheets, you open yourself up to errors and risk. That’s a recipe for inaccurate historical and projected data. You will not want potential investors or acquirers uncover this during due diligence, so be prepared ahead of time.”

The “Model”

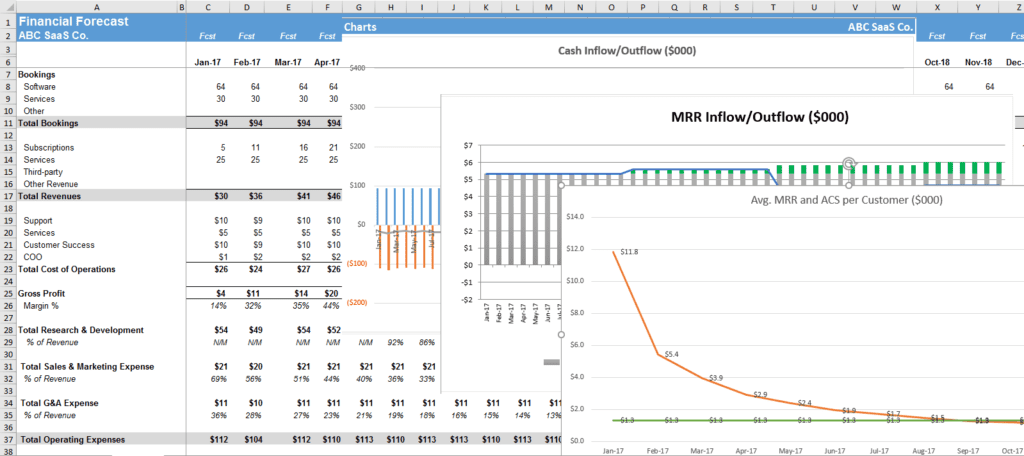

During the process, you and your bankers will work on the “model,” a detailed long-term financial forecast of your business. I will not sugar coat this. This will be painful if you have not been regularly forecasting your financials prior to running a process.

You’ll have to forecast your revenue lines, COGS, operating expenses, and headcount to a detailed level. For example, you’ll want to forecast your revenue by product line and itemize your assumptions for churn, expansion, migrations, and so on.

The more backup behind your assumptions, the better. Meaning, I can point to this historical number or metric to substantiate why I am forecasting 25% growth.

And, of course, you will be asked about the metrics. What’s your CAC payback period? How’s your sales and marketing efficiency?

“We’ve worked with hundreds of B2B SaaS businesses who have pitched their business to investors and acquirers,” says McCormick. “The right metrics and analytics not only provide insight into performance and growth, they are now table steaks. Being financially prepared to have these conversations is crucial – and that means having bullet proof GAAP financials and subscription performance metrics. If you don’t, you run the risk of a lower valuation or having your business overlooked completely.”

SaaS Metrics

I am a big believer in the philosophy that you can’t forecast your business accurately if you don’t know where you’ve been. Before you enter a sell-side process, you need to establish your baseline SaaS metrics (CAC, CAC payback period, LTV, etc.) to be able to speak intelligently about your business and help bidders become more comfortable with your business model.

These answers should be at the tip of your tongue – ready to fire off answers as soon as their asked. What’s your CAC Payback Period? Twelve months. Next question.

You will not have an answer for everything, but preparation is key.

Conclusion

The time is now to invest in improving your financial processes and financial data. Even if you are not thinking about taking on an investment, it takes time to improve your technology, reporting, and processes. And, yes, you’ll need GAAP recurring revenue by customer for the previous three to five years. If that scares you, start planning today for the time when you are sitting in your own management presentation.

Doing your homework now will save you 2x the time and headache during the process. The better technology and data you have prior to entering, the smoother the process will go and your numbers will be more believable.

Thank you for the added comments, Tim. Tim McCormick is CEO of SaaSOptics, a cloud-based subscription management platform that enables emerging and growth B2B subscription businesses the ability to eliminate their dependency on spreadsheets and streamline their financial operations, reporting and performance metrics.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.