Inspired by a podcast on the Tropical MBA on property investment, I thought that I would dust off my Income Property Valuation Model that I created about ten years ago when daydreaming about investing in rental or income properties. I usually post about SaaS economics and forecasting, but it is good to change the subject every now and then.

Since I love building Excel models, I searched the Internet and books on this real estate valuation to find the finance theory around income property valuation and real estate cash flows.

I don’t remember now where I found the structure of this real estate valuation model, but I thought it might be of interest to those who invest in real estate and income properties or are thinking about investing in real estate.

You can download the Excel model below.

I realize that real estate investing gets much more complicated than this valuation model, but it could be a great start for those new to real estate investing and modeling cash flows and returns. Otherwise, how do you know if the income property is a good investment? Or you can continue to iterate on this valuation model.

Real Estate Valuation Model Components

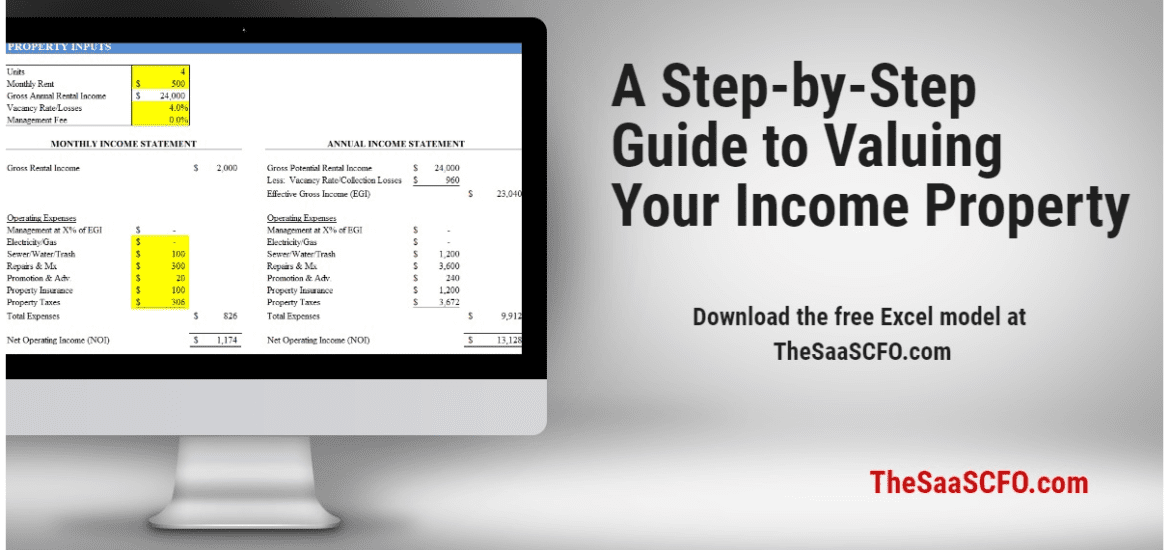

With my latest models, I create step-by-step instructions with links to guide you through the model. I won’t rehash the instructions here (download the model below), but I will give you an idea of how the model is setup and what it can do for you.

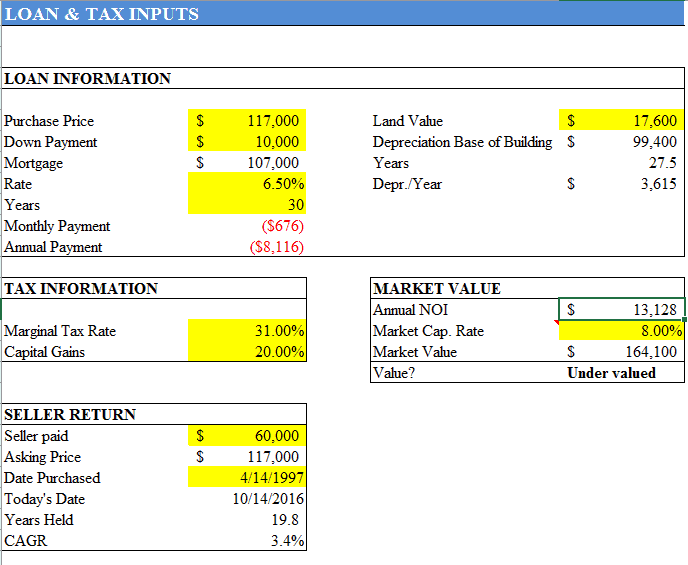

Step 1 – Loan and Tax Inputs

This tab will capture inputs related to loan information, tax rates, and property information. With these inputs it will determine your mortgage payment, the seller’s return, the property’s depreciable base, and a simple market valuation based on net operating income (NOI) and an assumed market capitalization rate.

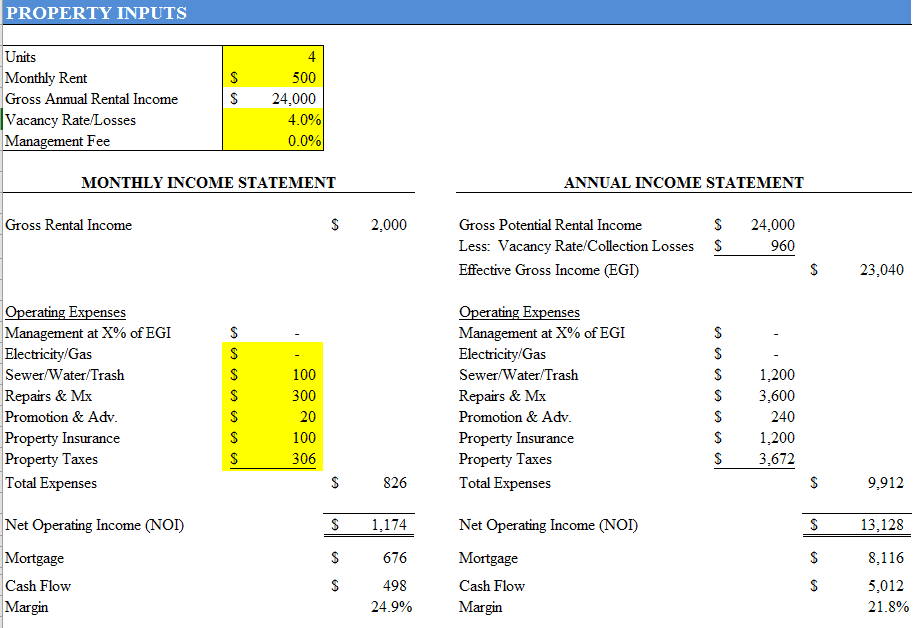

Step 2 – Income Property Inputs

In this tab, you enter rental information (units, rent), vacancy assumptions, and operating expense assumptions. With these inputs, this tab will create an average monthly income statement and an annual income statement so that you can determine net operating income, cash flow, and margin.

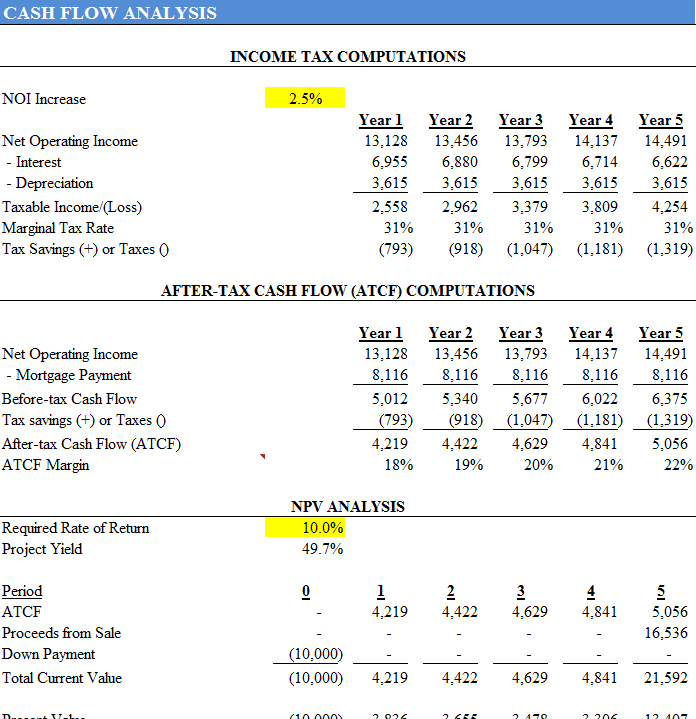

Step 3 – Real Estate Cash Flow Analysis

With the hard work done in step 1 and 2, you will only need to enter an inflation assumption for net operating income for the five year cash flow forecast and a discount rate for the required rate of return for the NPV (net present value) analysis.

Based on the inputs so far, this tab forecasts your taxable income, your before and after-tax cash flow, and the net present value (NPV) of this project assuming a five-year investment horizon.

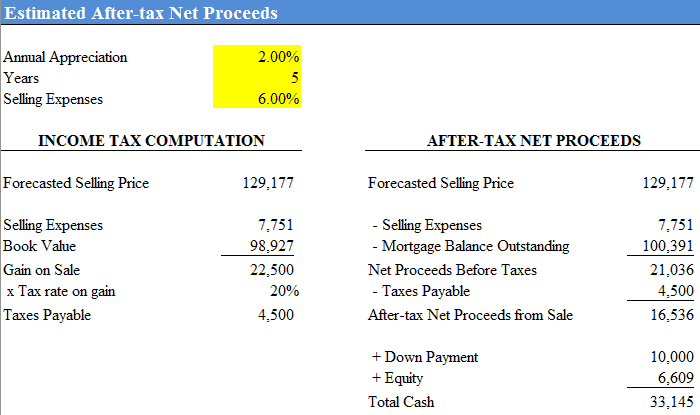

Step 4 – Property Sale Proceeds

Just three inputs are required on this tab to determine your income tax liability on the sale of your property and the after-tax proceeds from the sale.

Step 5 – Review Your Analysis

That’s it. You now have your very own income property valuation model. Use this model to review your cash flows, margins, income statement, NPV analysis, and proceeds analysis.

I believe this provides you a good high-level financial analysis of how an investment property will perform. This model can be a great way to assess opportunities in your market or to analyze the performance of existing rental properties.

Real estate is outside of my normal operating experience, so please let me know what feedback you have on this model, what works or doesn’t work, and what models you use to analyze income properties.

If you do not receive the download, please contact me.

I have worked in finance and accounting for 25+ years. I’ve been a SaaS CFO for 8+ years and began my career in the FP&A function. I hold an active Tennessee CPA license and earned my undergraduate degree from the University of Colorado at Boulder and MBA from the University of Iowa. I offer coaching, fractional CFO services, and SaaS finance courses.

Hi Ben, quick question and I’m sorry if I’m missing a simple concept, but I’m having trouble wrapping my head around the last section of the proceeds tab. Below, I don’t understand “total cash” being sum of after tax net proceeds from sale + down payment + equity.

From the way I’m look at the logic, the “total Cash” would be what the seller receives, which is the net proceeds. The net proceeds have already calculated in the equity + down payment (minus all taxes + expenses).

Can you explain the purpose of this total cash calculation, since that logically feels like double count.

Thank you SO much for this worksheet. I can’t tell you how hopeful it is!

Hi Andrea,

Great question. It’s been a while since I created this model and I’m also wondering what that cash number means. It doesn’t seem to tie out. I’d ignore for now. I’ll post an updated model if I can find my original notes.

Ben